- Home

- »

- Medical Devices

- »

-

U.S. Radiofrequency Electrosurgery Generators Market 2030GVR Report cover

![U.S. Radiofrequency Electrosurgery Generators Market Size, Share & Trends Report]()

U.S. Radiofrequency Electrosurgery Generators Market Size, Share & Trends Analysis Report By Type (Monopolar, Bipolar, Hybrid), By Application (General Surgery, Gynecological Surgery, ENT Surgery) By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-607-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. radiofrequency electrosurgery generators market size was valued at USD 346.62 million in 2024 and is expected to grow at a CAGR of 2.63% from 2025 to 2030. The rising number of surgical procedures, the rise of minimally invasive techniques, and advancements in electrosurgical technology are anticipated to drive the U.S. radiofrequency electrosurgery generators industry over the forecast period. According to the data published by Paras Health in January 2025, over 13 million laparoscopic procedures are performed globally each year. Such a large number of minimally invasive procedures and the availability of radiofrequency (RF) electrosurgery generators are anticipated to propel the market growth in the coming years.

Patients and healthcare providers increasingly prefer minimally invasive procedures for their numerous benefits, including faster recovery times, reduced pain, minimal scarring, and shorter hospital stays. These advantages are driving a global shift toward less invasive surgical techniques. Radiofrequency (RF) electrosurgery generators play a critical role in these procedures by enabling precise cutting and coagulation, thereby supporting the growing demand and market expansion for advanced surgical technologies.

Furthermore, many surgeries are now being performed using minimally invasive methods. According to the American Society of Plastic Surgeons (ASPS) 2023 report, minimally invasive procedures increased by 7% year-over-year, with over 25 million procedures performed. This surge highlights the growing preference for less invasive options in reconstructive and aesthetic surgery. The widespread use of RF electrosurgery generators in plastic and cosmetic procedures is expected to play a crucial role in sustaining this growth trajectory, driving further expansion of the RF electrosurgery generators market over the forecast period.

The increasing burden of chronic diseases, such as cancer, cardiovascular conditions, and neurological disorders, is a significant driver of growth in the radiofrequency (RF) electrosurgery generator market. These conditions often require surgical intervention, where precision and minimal tissue damage are critical. For instance, the RF 3000 Generator from Boston Scientific is designed explicitly for thermal coagulation and necrosis of soft tissues. It is commonly used for partial or complete ablation of nonresectable liver lesions, offering a minimally invasive treatment alternative. Thus, with the growing prevalence of chronic disorders, demand for radiofrequency electrosurgery generators is anticipated to increase significantly over the forecast period.

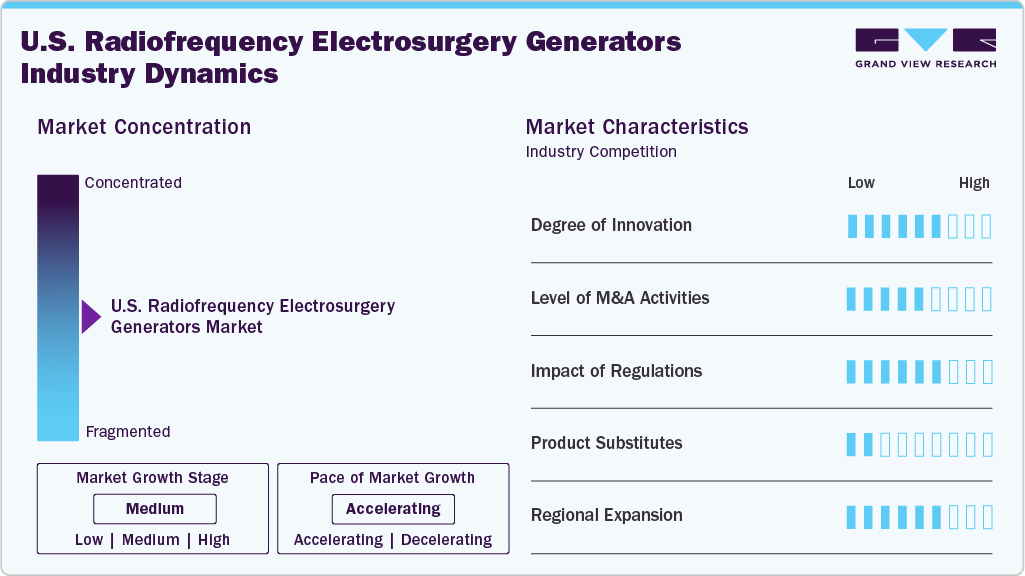

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The U.S. radiofrequency electrosurgery generators industry is characterized by a moderate degree of growth owing to the rising prevalence of chronic diseases, the increasing number of surgical procedures, and technological advancements in electrosurgery devices.

The degree of innovation in the U.S. radiofrequency (RF) electrosurgery generator market is considered moderate, as ongoing research and industry efforts are focused on expanding the clinical utility of RF devices and enhancing their features. For example, a study sponsored by Baylor College of Medicine in June 2025 evaluated the BiZact device-a bipolar electrosurgical tool utilizing RF energy-for its effectiveness in reducing operative time and post-surgical complications, highlighting the potential for further advancements in the field.

Mergers and acquisitions in the market can accelerate innovation, expand product portfolios, and strengthen distribution networks. These strategic moves enhance market competitiveness, streamline R&D, and enable companies to offer integrated surgical solutions, ultimately driving market growth and improving access to advanced electrosurgical technologies.

In the U.S., the RF electrosurgery generator market is regulated by the Food and Drug Administration (FDA), which plays a critical role in ensuring the safety and efficacy of these devices. In April 2025, the FDA approved an Investigational Device Exemption (IDE) application for the SIRA RFA Electrosurgical Device, intended for use in breast cancer patients undergoing breast-conservation surgery. This device is designed to be used in conjunction with a radiofrequency electrosurgical generator. This approval paves the way for a U.S. feasibility study, demonstrating how regulatory support can drive innovation, clinical adoption, and market expansion.

Some recently approved products by the FDA are mentioned below:

Company Name

Product Name

Approval Date

Ethicon

Megadyne Electrosurgical Generator

January 2022

Intuitive Surgical

da Vinci E-200 Electrosurgical Generator

November 2022

Intuitive Surgical

E-100 Electrosurgical Generator

November 2019

Source: FDA, Grand View Research Analysis

Type Insights

The monopolar segment dominated the market, accounting for 59.66% of the revenue in 2024 due to its versatility and widespread clinical adoption. Monopolar electrosurgery supports multiple modalities, including cutting, blending, desiccation, and fulguration, making it suitable for a wide range of surgical procedures. Monopolar systems are a preferred choice among surgeons and healthcare facilities.

The bipolar segment is expected to grow fastest over the forecast period, driven by its enhanced safety profile and precision. Unlike monopolar systems, bipolar electrosurgery uses lower voltages and confines the electrical current to the tissue between the two arms of the forceps electrode. This localized energy delivery reduces the risk of unintended tissue damage and significantly lowers the chance of patient burns. Bipolar technology is especially suited for procedures involving delicate or confined areas where tissue can be easily grasped by forceps. Its controlled energy application makes it ideal for use in patients with implanted electronic devices, as it minimizes the risk of current interference. While bipolar systems are less effective in cutting or coagulating large bleeding areas, they provide superior control and safety in targeted surgical applications. The growing preference for precision and patient safety is expected to drive the segment's growth.

Application Insights

The general surgery segment dominated the market in 2024. The increasing number of surgical procedures, along with the rising demand for efficient and minimally invasive techniques, is significantly contributing to the growth of the general surgery segment. Radiofrequency (RF) generators are commonly used in general surgery due to their precision in tissue dissection and coagulation. Moreover, general surgery has the largest number of specialists. As reported by the American Board of Surgery in February 2025, there are 31,816 board-certified general surgeons in the U.S.-the highest number among all medical specialties, which further supports the expansion of this segment.

The neurological surgery segment is expected to experience the fastest growth in the market during the forecast period. This growth is driven by the rising prevalence of neurological disorders and the demand for precision in delicate brain and spinal procedures. According to a study published by ScienceDirect in March 2025, nearly 10 million Americans reported experiencing a traumatic brain injury (TBI) in 2023.

End Use Insights

The hospital segment dominated the market and accounted for the largest revenue share, 32.21%, in 2024. High patient volumes, advanced surgical infrastructure, and greater access to skilled professionals drive this dominance. Hospitals are primary centers for elective and emergency surgeries, requiring versatile and reliable RF electrosurgical equipment. Additionally, increasing investments in healthcare facilities, growing adoption of minimally invasive procedures, and favorable reimbursement policies contribute to sustained demand for RF generators in hospital settings, further strengthening the segment’s growth.

The specialty clinics segment is expected to register the highest CAGR during the forecast period, driven by the growing number of specialized clinics focusing on fields such as dermatology, urology, gynecology, ENT, and plastic surgery. The increasing volume of surgeries supports this growth. For instance, cosmetic procedures reported by American Society of Plastic Surgeons (ASPS) members rose by 5 % in 2023, from 1,498,361 procedures in 2022 to 1,575,244 in 2023. These clinics increasingly depend on radiofrequency electrosurgery generators for precise, minimally invasive treatments, fueling rapid market expansion and adoption of advanced surgical technologies.

Key U.S. Radiofrequency Electrosurgery Generators Company Insights

ETHICON (Johnson & Johnson), Abbott, Olympus America, Sutter Medical Technologies USA, elliquence, Medtronic, Boston Scientific Corporation or its affiliates, Aspen Surgical Products, Inc., Erbe USA, Incorporated, and Intuitive Surgical are some of the major players in the market. Industry players engage in strategic initiatives, including partnerships, product approvals, and clinical trials. Moreover, launching novel products is anticipated to boost the competitive rivalry in the U.S. radiofrequency electrosurgery generators market.

Key U.S. Radiofrequency Electrosurgery Generators Companies:

- ETHICON (Johnson & Johnson)

- Abbott

- Olympus America

- Sutter Medical Technologies USA

- elliquence

- Medtronic

- Boston Scientific Corporation or its affiliates.

- Aspen Surgical Products, Inc

- Erbe USA, Incorporated

- Intuitive Surgical

Recent Developments

-

In April 2025, the FDA approved the Investigational Device Exemption (IDE) application for the SIRA RFA Electrosurgical Device, allowing the initiation of a U.S. feasibility study in breast cancer patients undergoing breast-conservation surgery. Developed by Innoblative, the SIRA device works with a radiofrequency electrosurgical generator to efficiently coagulate and ablate large surface areas during open abdominal procedures, minimizing the need for repositioning and enhancing surgical efficiency.

-

In October 2024, Soniquence, LLC, a recognized player with over 60 years in RF technology, became the global service and support provider for all Ellman RF devices. This strategic move highlights Soniquence’s expertise in RF technology and aligns with ongoing industry efforts to enhance device support, reliability, and customer satisfaction across surgical specialties.

U.S. Radiofrequency Electrosurgery Generators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 357.84 million

Revenue forecast in 2030

USD 407.45 million

Growth rate

CAGR of 2.63% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Type, application, end use

Country Scope

U.S.

Key companies profiled

ETHICON (Johnson & Johnson); Abbott; Olympus America; Sutter Medical Technologies USA; elliquence; Medtronic; Boston Scientific Corporation or its affiliates.; Aspen Surgical Products, Inc; Erbe USA, Incorporated; Intuitive Surgical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Radiofrequency Electrosurgery Generators Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. radiofrequency electrosurgery generators market report based on type, application, and end use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monopolar

-

Bipolar

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Gynecological Surgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

Urological Surgery

-

ENT Surgery

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Dermatology Clinics

-

Urology Clinics

-

Gynecology Clinics

-

ENT (Ear, Nose, and Throat) Clinics

-

Plastic Surgery Clinics

-

-

Ambulatory Surgical Centers (ASCs)

-

Dentistry and Oral Surgery Clinics

-

Oral Surgery Practices

-

Periodontics Clinics

-

-

Orthopedic and Sports Medicine Clinics

-

Pain Management Clinics

-

Endoscopy Centers

-

Burn and Trauma Centers

-

Research and Clinical Trial Centers

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."