- Home

- »

- Electronic & Electrical

- »

-

Singapore Household Appliances Market Size Report, 2030GVR Report cover

![Singapore Household Appliances Market Size, Share & Trends Report]()

Singapore Household Appliances Market Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Distribution Channel (Electronic Stores, Online), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-616-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

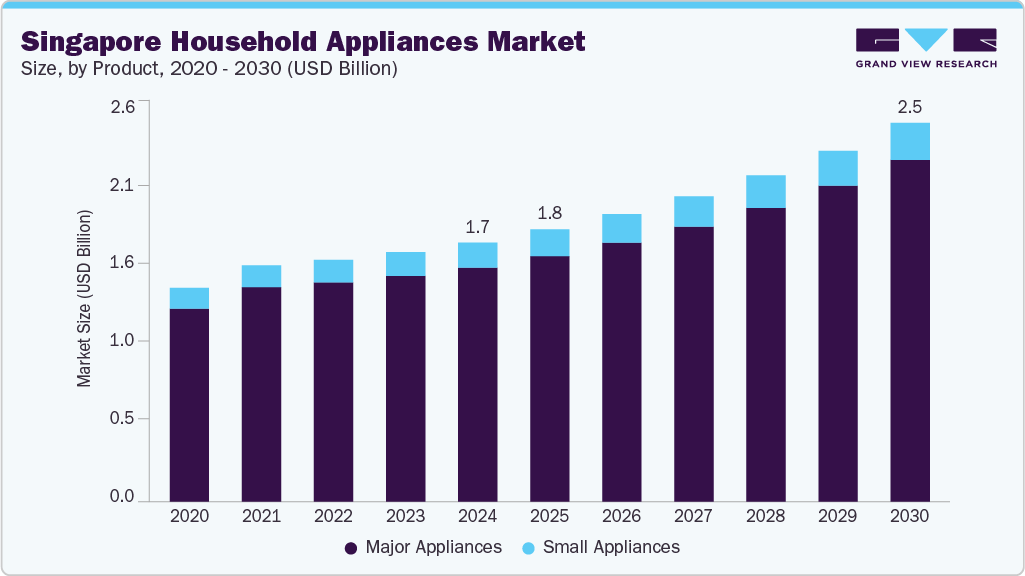

The Singapore household appliances market size was estimated at USD 1.75 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. The demand for household appliances in Singapore is shaped by rising disposable income, increasing consumer sophistication, and a growing preference for smart, sustainable, and energy-efficient appliances. As consumer electronics and smart home appliances become more accessible through electronics stores and e-commerce distribution channels, the appliance market in Singapore is positioned for sustained growth.

The convergence of technological innovation, consumer preferences for convenience and sustainability, and government initiatives to promote energy-efficient appliances collectively drives the evolving landscape of the appliance market. These factors will continue to influence appliance adoption patterns, market competitiveness, and the future development of the appliance manufacturing industry in Singapore.

Market growth in the country is primarily driven by increasing disposable income and evolving consumer trends toward modern, convenient living. As Singapore’s middle- and high-income households experience steady income growth, there is a heightened appetite for major appliances such as refrigerators, washing machines, and air conditioners, essential for daily living. The proliferation of smart home appliances, including 5 G-enabled appliances and integrated home automation systems, reflects a shift towards connected living environments. Consumers are increasingly seeking energy-efficient appliances, driven by rising environmental awareness and government incentives, which promote sustainable appliances that reduce energy consumption and utility costs.

Electronics stores and e-commerce distribution channels play a pivotal role in shaping appliance market growth in Singapore, providing consumers access to a broad range of built-in, freestanding, and small appliances. According to Zonos , Singapore is a rapidly growing e-commerce market with a strong digital payment infrastructure and minimal paperwork, supported by its WTO membership, which facilitates freer trade. Importing goods is relatively easy, with a landed cost fairness score of 4/5 due to low duty rates and duty-free imports. Shipping is highly accessible, with all major couriers operating in Singapore and accepting various payment methods, making it an attractive market. Over half of the population shops online, presenting significant opportunities for international e-commerce businesses.

Business and appliance manufacturers in Singapore are capitalizing on these consumer trends by innovating in developing household cooking appliances, built-in appliances, and small appliances that cater to space constraints and lifestyle preferences. The focus on energy-efficient appliances aligns with national sustainability initiatives, encouraging manufacturers to produce environment-friendly products that meet stringent safety and performance standards. The appliance market growth in Singapore is also supported by the expansion of the local appliance manufacturing sector, which emphasizes integrating smart features, IoT connectivity, and 5 G-enabled technology to meet rising consumer demand for advanced, sustainable appliances. This ongoing technological evolution is expected to accelerate the adoption rate of household appliances across diverse market segments.

Consumer Insights

In Singapore, consumers are highly discerning, prioritizing functionality, energy efficiency, and smart technology integration when purchasing appliances. Price sensitivity remains significant due to stagnant wages, high living costs, and inflation, leading many consumers to delay or reconsider large purchases. The market also shows a strong demand for compact and multifunctional appliances, reflecting limited home space and a focus on convenience.

Consumer Demographic Insights

Key trends include shifting toward premiumization and customization, with consumers willing to pay more for innovative features and reliable design. Energy efficiency and sustainability are increasingly important, driven by consumer awareness and government initiatives. Adoption of smart appliances with connectivity, automation, and app control is rising, particularly among tech-savvy buyers. E-commerce is rapidly growing, with online platforms offering convenience and competitive pricing. The market exhibits polarization, with demand for small, affordable appliances and larger, premium models. Despite economic uncertainties, growth is stronger in small appliances linked to health, wellness, and home-office needs. Singapore's most common household appliances include refrigerators, washing machines, air conditioners, and vacuum cleaners.

Pricing Analysis

Urbanization and higher disposable incomes drive demand for modern, energy-efficient, smart home appliances, prompting manufacturers to innovate and expand choices at competitive prices. Technological advancements, including 5G connectivity, enhance smart features and user experience, which can command premium prices and lead to price reductions in older models.

Competition among local and international brands such as Samsung, LG, and Panasonic fosters differentiation, encouraging better value and after-sales service. Government policies promoting sustainability influence supply and demand, with eco-friendly products often carrying a price premium due to higher production costs. Economic factors such as inflation and stagnant wages increase price sensitivity, prompting brands to offer diverse prices and promotions. Supply chain stability, supported by Singapore’s strategic logistics role, helps keep prices competitive despite global disruptions. The rise of e-commerce and experiential retail channels further enhances price transparency and consumer choice, balancing innovation with affordability.

LG refrigerator prices in Singapore ranged from approximately USD 1,200-USD 1,500 for entry-level 2-door models with capacities of 421-475L. Larger, premium models, such as the 611L 4-door GF-B6174TW, are priced at approximately USD 3,399, often discounted from USD 4,249. Prices vary based on capacity and features such as inverter technology, energy efficiency, and smart functions. Promotions can reduce prices by 10%-20%, offering consumers various options from basic to advanced appliances within the same brand.

Product Insights

Major appliances dominated the market in 2024. Major appliances such as refrigerators, washing machines, and air conditioners are essential for daily living in Singapore’s high-density urban environment, driving consistent demand due to the need for regular replacements and upgrades. Singapore’s high disposable income and urban lifestyles encourage consumers to invest in modern, high-quality models with features such as energy efficiency and smart connectivity. Rapid technological innovation promotes frequent upgrades, supporting sustained demand. Accessibility through supermarkets, hypermarkets, specialty stores, and e-commerce facilitates widespread availability, comparison, and after-sales support, further fueling high sales volumes and continuous market growth.

Small appliances are projected to grow at the fastest CAGR of 6.9% over the forecast period. Singapore’s fast-paced urban lifestyle drives demand for compact, multifunctional appliances such as coffee makers, air fryers, and vacuum cleaners, catering to busy consumers seeking convenience. Rising disposable incomes enable consumers to invest in specialized appliances such as air purifiers and advanced kitchen gadgets that enhance comfort. The growth of e-commerce has made it easier to discover, compare, and purchase small appliances.

Distribution Channel Insights

Electronic stores led the market with a revenue share of 47.4% in 2024. Electronic stores in Singapore offer various household appliances, from large units such as refrigerators and air conditioners to small kitchen gadgets, attracting consumers seeking variety and expert advice. They emphasize expertise and reliable after-sales support, partnering with leading brands such as Samsung, LG, Panasonic, and Electrolux to ensure availability of the latest models. Despite e-commerce growth, many consumers prefer physical inspection of high-investment appliances. These stores often operate in strategic, accessible locations and maintain a strong online presence through omnichannel strategies to meet evolving shopping preferences.

Online distribution channels are anticipated to witness the fastest CAGR of 7.9% over the forecast period. Singapore’s mature e-commerce ecosystem, led by platforms such as Shopee and Lazada, offers extensive product choices, competitive pricing, and frequent promotions, supporting robust online sales of household appliances. Nearly 60% of internet users shop weekly, with over 63% of purchases made via mobile. Consumers expect fast, reliable delivery, free shipping (top incentive for 57%), and next-day options. Social commerce thrives with 95% social media penetration, and popular categories include vacuum cleaners (26.7%), rice cookers, air fryers, and food processors, driven by seamless omnichannel and live shopping experiences.

Key Singapore Household Appliances Company Insights

Some key companies operating in the market include Whirlpool Corporation; Samsung; LG Electronics; AB Electrolux (publ); and Panasonic Holdings Corporation; among others.

-

LG Electronics Singapore offers innovative AI-powered household appliances for 2025, including refrigerators, washing machines, and dryers. These products prioritize space efficiency, freshness preservation, and advanced fabric care, complemented by convenient subscription leasing services for enhanced user experience.

-

Panasonic Singapore provides advanced household appliances featuring Japanese technology. Their CARE+ Edition laundry solutions offer effortless, sustainable care through AI Smart Wash, hybrid drying, and hygiene functions such as Blue Ag+ and StainMaster+, catering to everyday needs.

Key Singapore Household Appliances Companies:

- Whirlpool Corporation

- Samsung

- LG Electronics

- Panasonic Corporation

- Haier Group

- Robert Bosch LLC

- Häfele

Recent Developments

-

In April 2025, Samsung Electronics Singapore launched its Bespoke AI appliances, showcasing its “AI Home” vision. This new lineup, including refrigerators, laundry machines, vacuum cleaners, and air conditioners, integrates advanced AI, intuitive screens, and robust Knox security features to simplify home living and enhance user convenience in Singapore.

-

In December 2024, LG Electronics opened its ThinQ API. It acts as a digital connector, enabling software to exchange functions seamlessly. Developers could utilize open AI to integrate varied features from LG AI appliances into their systems/programs, improving their services.

-

In November 2024, Panasonic Manufacturing Malaysia Berhad (PMMA) launched the KDK brand Home Shower in Singapore.

Singapore Household Appliances Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.75 billion

Revenue forecast in 2030

USD 2.55 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

Singapore

Key companies profiled

Whirlpool Corporation; Samsung; LG Electronics; Panasonic Corporation; Haier Group; Robert Bosch LLC; Häfele

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Singapore Household Appliances Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Singapore household appliances market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The Singapore household appliances market size was estimated at USD 1.75 billion in 2024

b. The Singapore household appliances market is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2030.

b. Electronic stores led the market with a revenue share of 47.4% in 2024. Electronic stores in Singapore offer various household appliances, from large units such as refrigerators and air conditioners to small kitchen gadgets, attracting consumers seeking variety and expert advice. They emphasize expertise and reliable after-sales support, partnering with leading brands such as Samsung, LG, Panasonic, and Electrolux to ensure availability of the latest models. Despite e-commerce growth, many consumers prefer physical inspection of high-investment appliances. These stores often operate in strategic, accessible locations and maintain a strong online presence through omnichannel strategies to meet evolving shopping preferences.

b. Some prominent players in the Singapore household appliances market include Whirlpool Corporation; Samsung; LG Electronics; Panasonic Corporation; Haier Group; Robert Bosch LLC; Häfele

b. The demand for household appliances in Singapore is shaped by rising disposable income, increasing consumer sophistication, and a growing preference for smart, sustainable, and energy-efficient appliances. As consumer electronics and smart home appliances become more accessible through electronics stores and e-commerce distribution channels, the appliance market in Singapore is positioned for sustained growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."