- Home

- »

- Electronic & Electrical

- »

-

Poland Household Appliances Market, Industry Report, 2030GVR Report cover

![Poland Household Appliances Market Size, Share & Trends Report]()

Poland Household Appliances Market Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Distribution Channel (Online, Electronic Stores, Exclusive Brand Outlets), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-614-1

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Poland Household Appliances Market Trends

The Poland household appliances market size was valued at USD 4.58 billion in 2024 and is anticipated to grow at a CAGR of 4.3% from 2025 to 2030. The presence of multiple household appliance manufacturers and significant investments and facility expansions initiated by key market participants in Poland are primarily driving the growth of this market. A growing share in global trade of home appliances and improved availability of multiple products offered by global brands are expected to support further growth during the forecast period.

Poland has been one of the preferred locations for multiple facilities manufacturers. Factors such as the long-standing history of manufacturing household appliances in Poland, the presence of skilled labor, and the availability of adequate infrastructure in the country facilitate increasing investments in this market. For instance, in January 2025, Panattoni, one of the industrial real estate developers, announced its collaboration with BSH Home Appliances. Panattoni has been selected to build a new large facility in Rudna Wielka near Rzeszów, specifically for the small appliance production of BSH. Such expansions and strategic advancements by household appliance manufacturers are expected to develop lucrative growth opportunities for this market.

Poland has one of the lowest unemployment rates in Europe. In addition, a large share of Poland's population is aged 35 to 50, contributing to the major user group for the household appliances market. Appliances such as refrigerators, washing machines, vacuum cleaners, and dishwashers are increasingly utilized by customers in this age group for the convenience and assistance offered by advanced technology in various tasks.

Access to logistics and infrastructural support also facilitates the growth of Poland's household appliances market. The presence of multiple logistics and warehousing service providers in the country supports the supply chain activities of this market. Improvements in capabilities and storage capacity initiated by key players in warehousing are expected to develop novel opportunities. For instance, in December 2024, one of the supply chain solutions providers, ROHLIG SUUS Logistics SA, announced the opening of a newly designed warehouse in Warsaw, dedicated to handling a larger volume of goods for a global manufacturer of household appliances, Hisense. Such developments are expected to facilitate growth over the forecast period.

Consumer Insights

Consumers across Poland are highly aware of various factors such as consumer rights, energy efficiency, and the environmental impact of consumption patterns. However, price plays a vital role in consumers' purchase decisions. Polish consumers value innovation and are inclined towards using modern technologies. Social media influence also shapes consumer behavior patterns in Poland.

The increasing availability of household appliances through online platforms and e-commerce websites influences consumer trends. Promotional offers and discounts from major players in the e-commerce industry are drawing greater customer engagement in Poland. While many consumers are willing to adjust their shopping habits to reduce their environmental impact, fewer are interested in paying a premium for sustainable products.

Pricing Analysis

The price of various products and services directly influences purchase decisions in Polish markets. Factors such as the functionality of the appliance, technology features, key attributes, size, storage capacity, finishing, and energy efficiency rating contribute to the pricing point of household appliances. Products powered by modern technologies and compatible with built-in installations are offered at higher prices than freestanding devices. In addition, products intended for individual users, such as coffee makers, juicers, electric trimmers, irons, and hair dryers, are available at significantly lower prices than major appliances such as washing machines, dryers, refrigerators, and air conditioners.

Multiple major brands such as Samsung, BSH Home Appliances, Hisense, and others offer extensive product portfolios in this market. Key companies provide various products at different price ranges based on significant product features and the technological capacity of appliances. For instance, a Hisense cross door fridge with 216-liter freezer capacity is available in Poland at approximately USD 2,159.00. One of the Hisense side by side freestanding refrigerators is available at nearly USD 1,229.00. Such price differences are primarily driven by capacity, energy consumption requirements, and features such as ice dispenser, low noise operations, and total no frost.

Product Insights

The major appliances segment held the largest revenue share of Poland household appliances market and accounted for 86.0% in 2024. This segment's growth is mainly driven by the growing adoption of appliances such as high-end built-in refrigerators, easy-to-install and affordable freestanding washing machines, dishwashers, and advanced vacuum cleaners. Local customers' increasing inclination toward the use of smart kitchen appliances, built-in cooktops, and ovens powered by modern technologies also contributes to its further growth.

The small appliances segment is projected to experience fastest CAGR over the forecast period. Small appliances include space heaters, coffee makers, toasters, juicers, hair dryers, toasters and others. These appliances are often offered by multiple manufacturers and marketers at competitive pricing. Easy availability and accessibility through e-commerce websites also contributes to the growth experienced by this segment.

Distribution Channel Insights

The electronic stores segment held the largest revenue share of the Poland household appliances market in 2024. Growth of this segment is mainly driven by the factors such as increasing inclination among brands to feature products in electronic stores to enhance brand visibility, easy access to electronic stores, and growing demand for household appliances from urban consumers.Electronic stores often feature large number of products offered by various brands, attracting more customers. Local electronic stores also provide seasonal discounts and numerous offers to customers.

The online distribution segment is projected to experience fastest CAGR over the forecast period. The growth of this segment is primarily influenced by the changing preferences of consumers, inclination towards buying appliances through online portals after thorough comparisons with other products, and easy accessibility to brand products through e-commerce websites. In addition, intelligence-driven marketing strategies embraced by the key brands and effective technology assistance provided to ad campaigns also generate growth in online purchases of household appliances in the Polish market.

Key Poland Household Appliances Company Insights

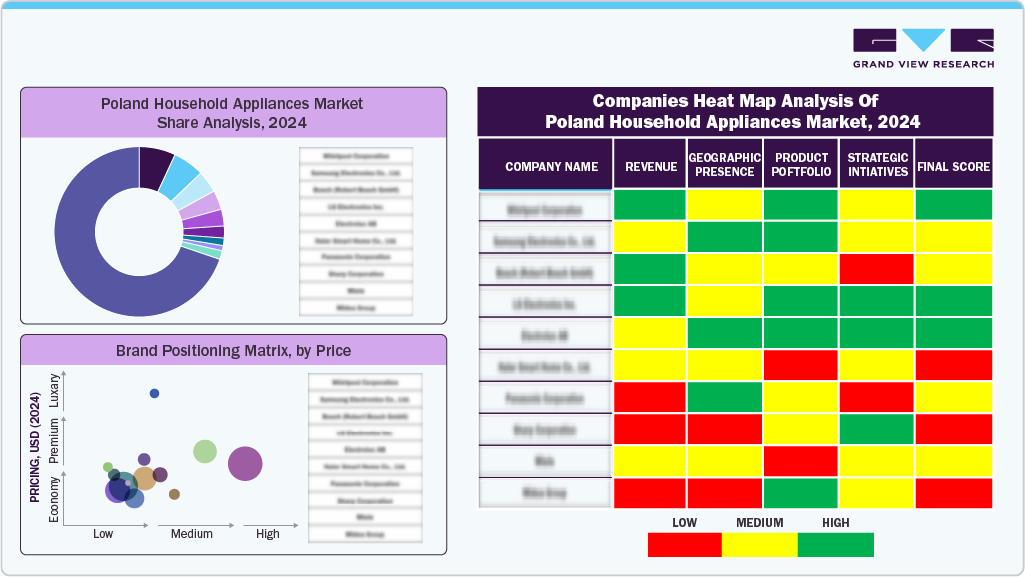

Some of the key companies operating in Poland household appliances market include Electrolux AB, Haier Inc., AMICA GROUP, Samsung, Beko, and others. Major market participants embraces strategies such as increasing production footprint across Poland, and improving distributor networks through collaborations.

-

AMICA GROUP, a global manufacturing organization from Wronki, Polad, specializes in household appliances such as refrigerators, dishwasher, washing machines, wine coolers, and others. It operates multiple brands in various markets including Amica, Hansa, and FAGOR.

-

Hisense manufactures and distributes household appliances in more than 130 countries. It offers extensive portfolio of products including air conditioners, washing machines, refrigerators, vacuum cleaners, and others.

Key Poland Household Appliances Companies:

- Electrolux AB

- Haier Inc.

- AMICA GROUP

- Samsung

- Beko

- Hisense

Recent Developments

-

In May 2025, Schiessl Polska, distributor of Hisense air-conditioning in Poland, launched the Hisense HVAC Showroom & Training Centre in Warsaw, Poland, offering a professional, innovative space that combined advanced technology with a welcoming design across two distinct sections tailored for HVAC industry professionals.

Poland Household Appliances Market Report Scope

Report Attribute

Details

Market Size Value 2025

USD 4.76 billion

Revenue forecast in 2030

USD 5.86 billion

Growth rate

CAGR of 4.3% from 2025 - 2030

Base Year for Estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Electrolux AB; Haier Inc.; AMICA GROUP; Samsung; Beko; Hisense

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Poland Household Appliances Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Poland household appliances market report on the basis of product, distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The Poland household appliances market size was valued at USD 4.58 billion in 2024

b. The Poland household appliances market is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2030.

b. The major appliances segment held the largest revenue share of Poland household appliances market and accounted for 86.0% in 2024. This segment's growth is mainly driven by the growing adoption of appliances such as high-end built-in refrigerators, easy-to-install and affordable freestanding washing machines, dishwashers, and advanced vacuum cleaners. Local customers' increasing inclination toward the use of smart kitchen appliances, built-in cooktops, and ovens powered by modern technologies also contributes to its further growth.

b. Some prominent players in the Poland household appliances industry include Electrolux AB; Haier Inc.; AMICA GROUP; Samsung; Beko; Hisense

b. The presence of multiple household appliance manufacturers and significant investments and facility expansions initiated by key market participants in Poland are primarily driving the growth of this market. A growing share in global trade of home appliances and improved availability of multiple products offered by global brands are expected to support further growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."