- Home

- »

- Healthcare IT

- »

-

Menstrual Health Apps Market Size, Industry Report, 2030GVR Report cover

![Menstrual Health Apps Market Size, Share & Trends Report]()

Menstrual Health Apps Market Size, Share & Trends Analysis Report By Platform (Android, iOS), By Application (Period Cycle Tracking, Fertility & Ovulation Management, Menstrual Health Management), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-084-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Menstrual Health Apps Market Summary

The global menstrual health apps market size was estimated at USD 1.69 billion in 2024 and is projected to reach USD 5.07 billion by 2030, growing at a CAGR of 20.24% from 2025 to 2030, the growth is primarily driven by rising awareness about health among women.

Key Market Trends & Insights

- North America menstrual health apps market dominated with a revenue share of 38.4% in 2024.

- The menstrual health apps market in the U.S. is driven by tech-savvy consumers, high levels of reproductive health awareness, and widespread access to digital platforms.

- By platform, the Android segment dominated the market with the largest revenue share of 73.3% in 2024.

- By application, the period cycle tracking segment dominated the market with a revenue share of 64.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.69 Billion

- 2030 Projected Market Size: USD 5.07 Billion

- CAGR (2025-2030): 20.24%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing Market

In addition, the increase in digital literacy, widespread use of smartphones, higher disposable income, improved internet connectivity, and the emergence of new market players are also contributing to the market expansion.The growing adoption of wearable devices enables seamless tracking of physical activity, which enhances synchronization with menstrual health apps, driving market growth.

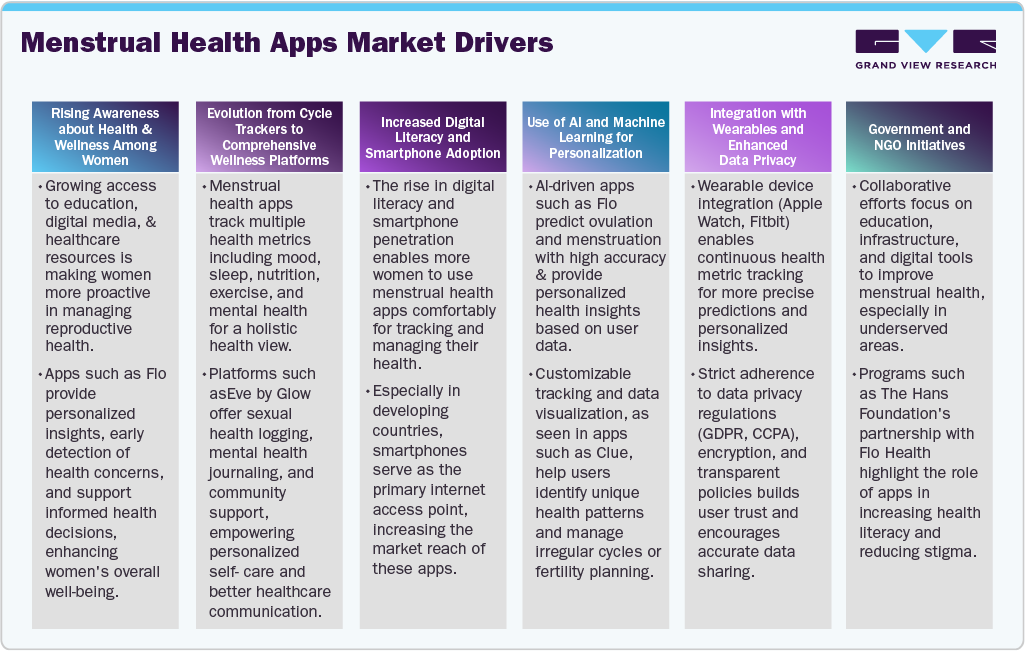

Rising Awareness About Health And Wellness Among Women

Rising awareness about health and wellness among women is driving the growth of the menstrual health apps market. With increasing access to education, digital media, and healthcare resources, women are becoming more proactive in managing their reproductive health. This has increased the need for easy-to-use digital tools that help track periods, fertility, and overall reproductive health. Apps such as Flo offer personalized insights for women, assist in early detection of health concerns, and support more informed health decisions. These apps play an important role in preventing health issues and enhancing everyday life. For instance, in November 2024, Flo Health, in partnership with FemTech India, launched the 'Pass It On Project'.This initiative aimed to boost women's health literacy by providing free Flo Premium subscriptions across India, focusing on menstrual health awareness and empowering women with essential reproductive health knowledge.

Evolution from Cycle Trackers to Comprehensive Wellness Platforms

Furthermore, these apps are evolving from simple cycle trackers to comprehensive wellness platforms. These apps incorporate a wide range of health metrics, including mood fluctuations, sleep patterns, nutritional intake, exercise routines, and mental health indicators, to provide users with a multidimensional view of their health. By tracking and analyzing these factors in relation to menstrual cycle phases, users gain valuable insights into how lifestyle and emotional well-being impact symptoms such as cramps, fatigue, or mood changes. This holistic approach empowers individuals to make more informed decisions about their health, enabling personalized self-care strategies and better communication with healthcare providers. For instance, Eve by Glow provides a multifaceted platform that extends beyond cycle tracking by offering a dedicated sexual health section for logging activity and contraception, supporting mental health through daily journaling and mood tracking, and fostering community engagement via forums for sharing experiences and support on topics from PMS to fertility.

Increased Digital Literacy And Smartphone Adoption

The significant rise in digital literacy, combined with the widespread use of smartphones, has greatly accelerated the growth of the menstrual health apps market. As more women become comfortable navigating digital tools and mobile applications, they are increasingly turning to technology to manage their health. Smartphones provide easy access to apps that assist with period tracking, fertility planning, and hormonal health information. This digital empowerment enhances user engagement and allows app developers to reach a broader audience, especially in developing regions where smartphones are often the primary means of internet access.

In addition, growing disposable incomes, particularly in urban and semi-urban areas, enable women to invest more in health and wellness technologies, including paid or subscription-based menstrual health apps. Moreover, with improved internet infrastructure, such as the expansion of 4G and 5G networks, users experience seamless app functionality even in remote locations. Together, these factors increase the accessibility and attractiveness of menstrual health solutions, driving higher adoption rates and contributing to the market’s expansion.

Use Of AI And Machine Learning For Personalization

Menstrual health apps employ AI and machine learning to tailor predictions and recommendations based on individual user data. This personalized approach improves accuracy and relevance, which is essential for conditions such as irregular cycles or fertility planning. For example, Flouses AI algorithms to predict ovulation and menstruation days with high accuracy by analyzing users' cycle data and symptoms over time. It also offers personalized health insights, including tips for managing PMS, hormonal acne, or mood swings. Clue similarly provides customizable tracking options and data visualizations, helping users identify patterns unique to their bodies' menstrual cycle and related health indicators.

The women’s health and fertility tracking app market is witnessing significant growth, driven by increasing funding and growing consumer interest in personalized reproductive health solutions. Investment in this sector continues to rise, driven by the wider use of digital tools that enable women to better track and manage their health. This rise in funding underscores the increasing acknowledgment of these apps as vital elements of contemporary healthcare and wellness. The data below presents the leading women’s health and fertility tracking apps, emphasizing their core features and funding.

Apps

Description

Funding (USD million)

Google Rating

Flo

AI-based mobile app that tracks and predicts menstrual cycles

269

4.6/5

Natural Cycles

A mobile app to track fertility and birth control

99.5

4.5/5

Clue

Fertility tracking app

56

4.3/5

Xiamen Meiyou

A social network for women and a menstruation period tracking app

Complete analysis will be included in the final deliverable

Grace.health

women's health tracking app

Glow

Fertility tracking platforms

Maya

a Smartphone app for women to track menstrual cycle

Dayima

app for period tracking and women’s health

Integration With Wearables And Enhanced Data Privacy

Technological advances and enhanced data privacy are key to building user trust and improving menstrual health apps. Integration with wearable devices such as Apple Watch and Fitbit allows automatic, continuous tracking of metrics such as heart rate, temperature, and sleep, leading to more accurate cycle predictions and personalized insights. For instance, Clue leverages this integration to minimize manual input and improve health monitoring. To protect sensitive data, apps employ advanced encryption, transparent privacy policies, and give users control over their information, including consent management and data deletion. Regulatory frameworks including GDPR and CCPA, enforce strict data protection standards, requiring developers to ensure legal compliance, transparency, and ethical data use. This promotes user confidence, encouraging more accurate data sharing and enhancing app personalization.

Government And NGO Initiatives

Governments and NGOs are increasingly partnering to improve menstrual health through education, infrastructure development, and digital solutions. For instance, The Hans Foundation in India collaborates with local organizations to address menstrual hygiene challenges by promoting menstrual health apps and distributing sanitary products. Initiatives such as UNICEF Global Menstrual Hygiene Programs

-

UNICEF leads menstrual health and hygiene activities worldwide through development and humanitarian programs.

-

Their work includes improving access to menstrual products, education, safe water and sanitation facilities, and breaking menstrual stigma in schools and communities globally

Market Concentration & Characteristics

The industry is witnessing high innovation, driven by advancements in artificial intelligence, machine learning, and data analytics. Modern apps offer period tracking for personalized health insights, mood and symptom analysis, fertility predictions, and even integrate with wearable devices for real-time health monitoring. For instance, UNICEF localized the Oky period tracker app in Tanzania, which was co-created with over 300 girls to address menstrual health challenges. Launched in May 2023, the app offers culturally relevant, offline-accessible information, empowering girls with accurate menstrual education. Over 1,600 downloads reflect its positive reception and impact.

The mergers and acquisitions (M&A) activities in the industry have been steadily increasing as companies aim to expand their user base, improve technological advancements, and strengthen their market position. Established health tech firms and digital wellness platforms are acquiring or partnering with niche menstrual health app developers to diversify their service offerings and enter new geographic markets. For instance, in May 2024, Noise, a leading Indian smartwatch brand, acquired SocialBoat, an AI-powered women's wellness platform, to improve its Luna Ring's health tracking capabilities. SocialBoat's AI algorithms analyze data from wearables to provide personalized recommendations on menstrual health, nutrition, fitness, and overall well-being.

Theindustry is increasingly influenced by evolving regulatory landscapes prioritizing data privacy, medical accuracy, and user safety. In regions such as the European Union, stringent regulations such as the General Data Protection Regulation (GDPR) and the Medical Device Regulation (MDR) mandate that apps handling sensitive health data implement explicit user consent mechanisms, ensure data anonymization, and, sometimes, obtain medical device certifications.

The industry is experiencing significant product expansion, driven by technological advancements and a growing emphasis on comprehensive women's health solutions. Leading applications are incorporating advanced features apart from basic period tracking to incorporate features such as mental health monitoring, AI-driven fertility predictions, and integration with wearable devices. For instance, in February 2025, Laiqa, an Indian-based femtech startup, launched the LAIQA app, combining AI and Ayurveda to support women's hormonal health. The app addresses menopause, fertility, PCOS, and overall wellness, offering personalized insights, expert consultations, and cycle-synced wellness plans.

Platform Insights

The Android segment dominated the market with the largest revenue share of 73.3% in 2024, owing to the increasing adoption of Android-based smartphones on account of their cost-effectiveness. For instance, according to BankMyCell.com, there are 3.9 billion Android smartphone users across the globe. Similarly, in the U.S., 43.8% of residents use Android smartphones. Thus, such a rise in the number of smartphone users is expected to drive segment growth in the coming years.

The iOS segment is anticipated to grow at a significant CAGR over the forecast period, driven by high-income users who prioritize privacy, advanced features, and premium services. The growth of this segment can be attributed to the high adoption and popularity of the iOS platform among consumers across the globe. According to data published by Business of Apps in 2021, the market share of iOS in the UK increased from 47% in Q3 of 2020 to 51.6% in Q3 of 2021.

Application Insights

The period cycle tracking segment dominated the market with a revenue share of 64.7% in 2024. Period cycle tracking remains one of the most widely used features in the menstrual health apps market. These apps allow users to record and predict their menstrual cycles, helping them prepare for upcoming periods and manage related symptoms. The rise in smartphone use and better understanding of digital health have made period tracking easier and more available to many people. In addition, user-friendly interfaces and reminder features help users stay consistent.

The fertility and ovulation management segment is anticipated to grow at a significant CAGR over the forecast period, driven by increasing awareness about reproductive health and the growing demand for non-invasive fertility planning solutions. Women increasingly use digital tools to predict ovulation windows and enhance conception chances. Features such as AI-powered predictions, symptom logging, and integration with wearable devices make these apps reliable and convenient, especially for those planning pregnancies or monitoring hormonal health.

Regional Insights

North America menstrual health apps market dominated with a revenue share of 38.4% in 2024. This is due to high digital literacy, widespread smartphone usage, and awareness about women's health. The presence of advanced healthcare infrastructure, the increasing emphasis on early detection and prevention of health issues, and the support from healthcare organizations and insurers for adopting digital health technologies are all key factors driving market demand.

U.S. Menstrual Health Apps Market Trends

The menstrual health apps market in the U.S. is driven by tech-savvy consumers, high levels of reproductive health awareness, and widespread access to digital platforms. Women are increasingly adopting apps for pregnancy planning, period tracking, and hormonal health monitoring. In addition, data privacy regulations and integration with devices such as Apple Watch and Fitbit encourage the growth of secure, reliable menstrual tracking apps.

Europe Menstrual Health Apps Market Trends

The menstrual health app market in Europeexhibits strong growth in the adoption of menstrual health apps due to progressive healthcare policies, a high level of awareness about menstrual and reproductive health, and an increasing emphasis on digital healthcare. Government-backed digital health initiatives and a growing wellness trend among women fuel demand across the region.

The UK menstrual health app market is driven by increased public discourse around menstrual health, rising acceptance of femtech, and strong mobile app penetration. Consumers are looking for tools that track cycles and offer mental health insights and expert advice. NHS support for digital health tools is further encouraging app usage.

Asia Pacific Menstrual Health Apps Market Trends

The menstrual health apps market in Asia Pacificis witnessing rapid growth due to rising smartphone penetration, improving internet infrastructure, and growing awareness about personal health management. A younger population base and government efforts to enhance digital healthcare access, particularly in countries including India, are accelerating adoption.

China menstrual health apps market has emerged as a key market with rising interest in women's wellness, supported by strong mobile app ecosystems and AI integration. The popularity of wearable tech and local innovations in health-focused apps are key drivers. In addition, China's urban population is showing increasing openness to using technology for health tracking, including menstrual health.

Latin America Menstrual Health Apps Market Trends

The menstrual health apps market in Latin Americais seeing growing demand as awareness about women’s health increases, particularly among urban populations. Mobile internet access and digital education campaigns are playing crucial roles in promoting health apps. In addition, cultural shifts and greater advocacy around menstrual hygiene and reproductive rights are influencing adoption.

Brazil menstrual health apps market demand is supported by increasing female participation in the workforce, better access to mobile health apps, and active social media use. Government health programs and partnerships with digital health providers are further helping to increase awareness and trust in menstrual health technologies.

Middle East and Africa Menstrual Health Apps Market Trends

The menstrual health apps market in the Middle East and Africa is gradually growing, driven by rising smartphone penetration, improved access to the internet, and efforts to break taboos surrounding menstruation. International NGOs and women's health initiatives are also promoting the use of health apps, especially in urban and semi-urban areas.

Saudi Arabia menstrual health apps market is rising due to digital adoption and a growing interest in personal wellness among women, which is supporting market demand. In addition, the country's advanced healthcare system supports innovation in digital health solutions. For instance, the IMC Women’s Health App, developed by the International Medical Center in Jeddah, offers comprehensive features, including menstrual cycle tracking, fertility monitoring, and symptom logging, aiming to empower women with personalized health insights.

Key Menstrual Health Apps Companies:

The following are the leading companies in the menstrual health apps market. These companies collectively hold the largest market share and dictate industry trends.

- Flo Health Inc.

- Glow, Inc.

- Biowink GmbH

- Planned Parenthood Federation of America Inc.

- Ovia Health

- MagicGirl

- Procter & Gamble

- Simple Design. Ltd

- Cycles

Key Menstrual Health Apps Company Insights

Key players operating in the menstrual health apps market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Flo Health Inc. is a leading femtech company behind Flo, a top female health app with 380 million downloads worldwide. Founded in 2015, Flo offers personalized menstrual, fertility, pregnancy, and menopause tracking, supported by 120+ medical experts. The company emphasizes privacy with features such as Anonymous Mode and achieved unicorn status in 2024 with a USD 1 billion+ valuation after raising USD 230 million. Flo also partners globally to expand access to premium health tools, especially in underserved regions.

Flo Health Inc.: Estimated Key Evaluation Metrics (2023 )

Metric

Estimated Value

Estimated Customer Acquisition Cost (CAC)

USD 5-USD 15

Annual Recurring Revenue (ARR)

USD 192 million

Number of Downloads

380 million downloads globally

Monthly Active Users (MAU)

60 million monthly active users.

Source: This information is obtained from the company's official website.

Recent Developments

-

In March 2025, Comma, a women's health startup founded by epidemiologist Miller Morris, secured USD 2 million in seed funding and launched Sara, a period tracking app.

-

In January 2025, A Nigerian non-profit, Big Family 360 Foundation, launched the HerPride app to help women track periods, order sanitary products, and connect with a supportive community.

-

In July 2024, Flo Health, the world's most downloaded women's health app, secured over USD 200 million in Series C funding from General Atlantic. This investment aims to expand Flo's features, including symptom analysis for perimenopausal and menopausal women, and enhance health literacy globally.

-

In December 2024, Asan Cup launched a free period tracking app that educates users on menstrual health and the environmental impact of period product choices.

-

In November 2024, Ove Care, a UK-based startup, introduced a free menstrual health app for girls aged 9 to 17. Addressing the lack of age-appropriate resources, the app offers over 40 educational lessons and quizzes about puberty and menstruation.

Menstrual Health Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.02 billion

Revenue forecast in 2030

USD 5.07 billion

Growth rate

CAGR of 20.24% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Flo Health Inc.; Glow, Inc.; Biowink GmbH; Planned Parenthood Federation of America Inc.; Ovia Health; MagicGirl ; Joii Limited; Procter & Gamble; Simple Design. Ltd; Cycles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Menstrual Health Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global menstrual health apps market report based on platform, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Period cycle tracking

-

Fertility & ovulation management

-

Menstrual health management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global menstrual health apps market is expected to grow at a compound annual growth rate of 20.24% from 2025 to 2030 to reach USD 5.07 billion by 2030.

b. North America dominated the menstrual health apps market with the highest share of 38.48% in 2024. This is attributable to the increasing digital literacy, widespread use of smartphones, higher disposable income, and improved internet connectivity.

b. The global menstrual health apps market size was estimated at USD 1.69 billion in 2024 and is expected to reach USD 2.02 billion in 2025.

b. Some key players operating in the menstrual health apps market include Flo Health Inc., Glow, Inc., Biowink GmbH, Planned Parenthood Federation of America Inc., Ovia Health, MagicGirl, Joii Limited, Procter & Gamble, Simple Design. Ltd, Cycles

b. The growth of the menstrual health apps market is primarily driven by rising awareness about health among women. In addition, the increase in digital literacy, widespread use of smartphones, higher disposable income, improved internet connectivity, and the emergence of new market players are also contributing to the market expansion. The growing adoption of wearable devices enables seamless tracking of physical activity, which enhances synchronization with menstrual health apps driving market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."