- Home

- »

- Medical Devices

- »

-

Italy Accident Insurance Market Size, Industry Report, 2030GVR Report cover

![Italy Accident Insurance Market Size (Gross Written Premium, New Business Premium), Share & Trends Report]()

Italy Accident Insurance Market Size (Gross Written Premium, New Business Premium), Share & Trends Analysis Report By Insurance Type (Public, Private), By Policy Type, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-600-5

- Number of Report Pages: 194

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Italy Accident Insurance Market Trends

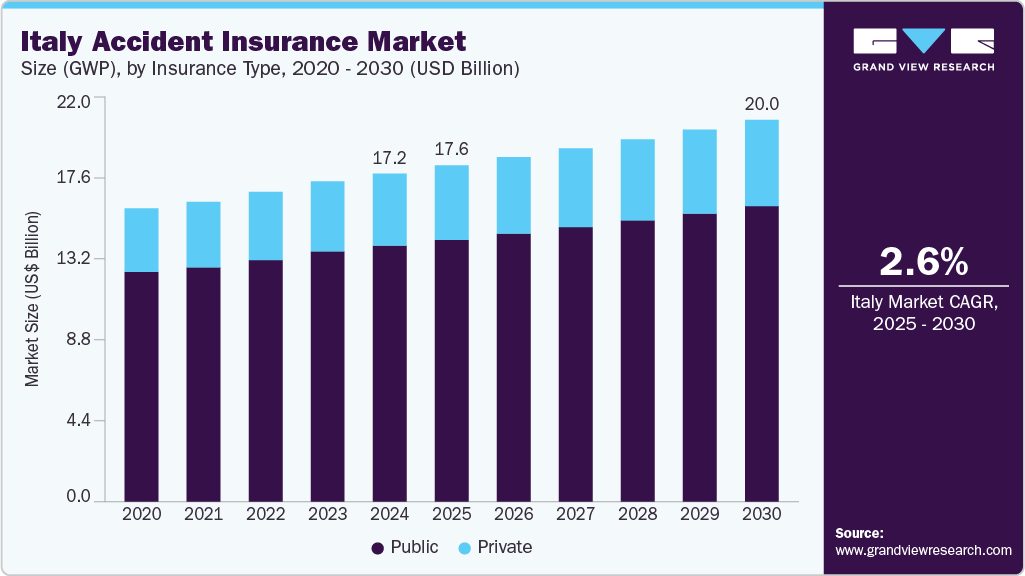

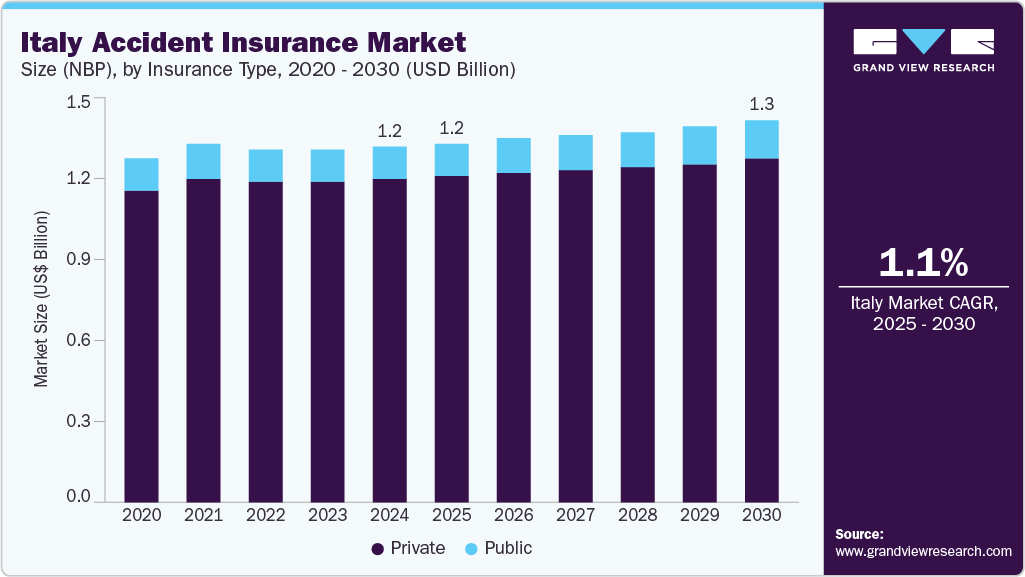

Italy accident insurance market size in terms of Gross Written Premium (GWP) was estimated at USD 17.22 billion in 2024 and is expected to grow at a CAGR of 2.58% from 2025 to 2030. The market size in terms of New Business Premium (NBP) was estimated at USD 1.22 billion in 2024 and is expected to grow at a CAGR of 1.13% from 2025 to 2030.

Furthermore, as per the Grand View Research analysis and estimates, there is a steady growth in the profitability of the accident insurance market, indicating further expansion.

Private Accident Insurance Profitability Estimates

Metric

Overall Market Estimate

Accident Loss Ratio Claims /Premiums)

41.8%

Accident Combined Ratio (CoR) (Claims + Expenses / Premiums)

78.00%

Source: Grand View Research Estimates

In addition, innovations such as telematics and digital platforms have transformed how insurance is marketed and managed. Insurers are now able to offer personalized policies based on individual behavior and risk profiles, which enhances customer engagement and satisfaction. Furthermore, technology facilitates quicker claims processing and better fraud detection mechanisms. For instance, Intesa Sanpaolo, in collaboration with academic and research institutions, has established the Anti Financial Crime Digital Hub (AFC Digital Hub) in Turin. The hub focuses on utilizing new technologies and AI to detect and prevent financial crimes, including fraud, by analyzing suspicious transaction patterns.

Economic stability plays a crucial role in the growth of the industry market. As disposable income increases, individuals are more likely to invest in additional private policies that complement their basic public coverage. In November 2024, Everest Insurance announced its expansion into Italy, establishing its headquarters in Milan. Operating under the name Everest Insurance (Ireland) DAC, Succursale Italiana, the company aims to offer a range of insurance solutions, including casualty and health coverage. This move signifies the growing attractiveness of the Italy accident insurance industry to international players.

In addition, the launch of the Antonio Pastore fund in January 2022 in Italy marks a significant advancement in safeguarding the well-being of executives in the commercial sector. This initiative demonstrates Italy's commitment to enhancing safety and security for professionals by providing comprehensive insurance coverage for collisions. It reflects a proactive approach to addressing the unique challenges executives face, ensuring they have the necessary protection in various aspects of their lives. This creates a more secure working environment and contributes to overall stability and confidence within the commercial landscape.

Furthermore, the growing legislative development in Italy mandating helmet use and third-party liability insurance for e-scooter riders is significantly driving the industry growth. For instance, in November 2024, the Italian government passed legislation requiring e-scooter riders to wear helmets and possess third-party liability insurance. This law aims to enhance safety and reduce accidents, reflecting the government's commitment to expanding insurance coverage in emerging mobility sectors.

Government Funding for Accident Victims in Italy

Administered By

Purpose

Eligibility

CONSAP (Ministry of Economic Development)

Guarantee fund for road crash victims involving uninsured or unidentified vehicles

Victims of accidents caused by uninsured or hit-and-run drivers

INAIL

National Institute for insurance against workplace casulaties

Workers injured on the job

Ministry of Infrastructure and Transport

Fund for victims of serious road accidents

Individuals with permanent disability or heirs of deceased

INPS (National Social Security Institute)

Disability allowance for individuals with permanent impairments due to accidents

Residents with medically certified disability

INPS and local health authorities (ASL)

Law providing assistance to disabled persons and caregivers

Accident victims recognized as disabled

Ministry of Justice

Compensation for victims of violent crimes, including criminal liability

Victims or heirs in case of manslaughter or serious bodily harm

Source: Grand View Research Analysis

Moreover, the rising incidence of lifestyle-related injuries has prompted increased demand for these insurance products that cover a broader range of activities beyond traditional workplace incidents. This trend reflects changing societal norms where physical activity is encouraged and carries inherent risks. Furthermore, there has been a growing recognition among individuals and businesses regarding the importance of risk management strategies. As people become more aware of potential risks associated with daily activities such as commuting or engaging in sports, there is an increased demand for both public and private accident insurance products.

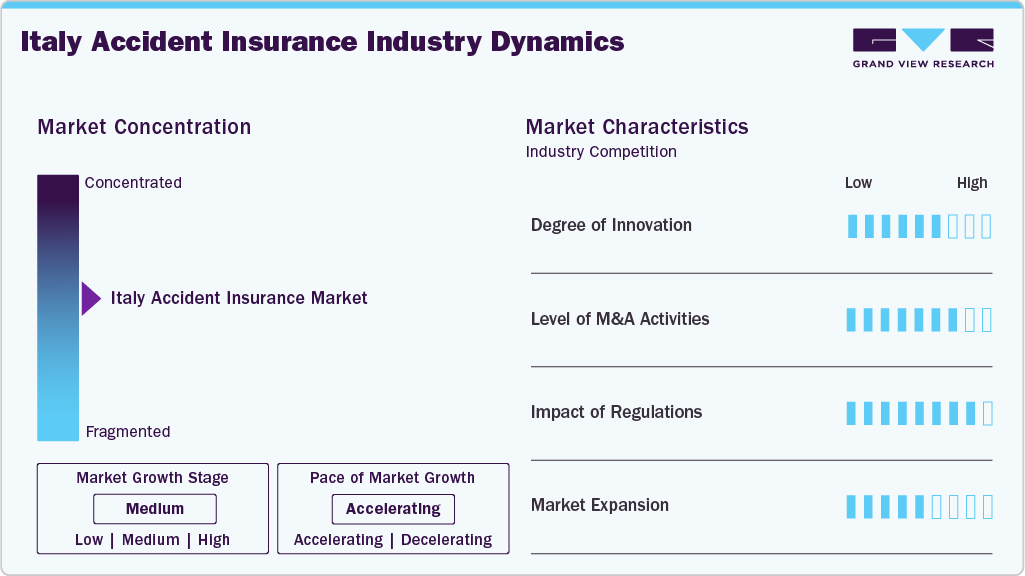

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of merger & acquisition activities, and geographic expansion. The market operates under a highly competitive and moderately consolidated structure. The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and the geographic expansion of the industry is high.

The degree of innovation in the market is significantly moderate, driven by digitalization, regulatory reforms, and personalized accident solutions. For instance, in 2024, Allianz launched the Insurance Copilot leverages generative artificial intelligence (AI) to streamline claims workflows and automate essential tasks. It assists claims handlers by summarizing data, analyzing documents, and drafting communications, thereby expediting the claims process and improving accuracy.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies are expected to expand their business geographies. In March 2024, Allianz completed the acquisition of Tua Assicurazioni S.p.A. from Assicurazioni Generali S.p.A., a leading Italian global insurance and asset management provider. The transaction, valued at USD 316.45 million, is in line with Generali's "Lifetime Partner24: Driving Growth" strategy in Italy, aimed at pursuing profitable growth, reducing complexity, and increasing P&C diversification.

The regulatory landscape in Italy has a significant impact on the market, mainly through frameworks aimed at enhancing consumer protection and ensuring the financial stability of insurers. The Institute for Insurance Supervision (IVASS) is the primary regulator that operates under the supervision of the Bank of Italy. The framework ensures compliance with both national and EU-level directives, focusing on consumer protection, market stability, and transparency. Moreover, the supervisory authority IVASS oversees the technical, financial, and operational aspects of insurance and reinsurance companies in Italy. It enforces compliance with the Private Insurance Code and subsequent amendments.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In March 2025, DUAL Europe announced the launch of its Accident & Health (A&H) business across Europe. This move marks a significant milestone in DUAL Europe's strategy to diversify its product range and provide greater choice for its brokers and clients in an expanding European market.

Insurance Type Insights

The market is segmented by insurance type into public and private. Public insurance is further segmented into corporate and retail policies. The public segment dominated the market in 2024 and accounted for the largest revenue share, 78.05%. Italy's public segment is primarily driven by the statutory system managed by INAIL (Istituto Nazionale per l'Assicurazione contro gli Infortuni sul Lavoro), which mandates coverage for employees across various sectors, including agriculture, commerce, healthcare, and education. This insurance system is employer-funded, meaning that employers are responsible for contributions based on the risk classification of their sector and overall payroll, without any direct financial input from employees.

INAIL, a public entity under the supervision of the Ministry of Labour and Social Policies, oversees the administration of this insurance, ensuring that workers are protected against workplace accidents, commuting incidents, and occupational diseases. The contributions collected from employers are reflected in the public Gross Written Premium (GWP), making it a crucial component of Italy’s social safety net for workers. In addition, reports from Italy’s Ministry of Labour and Social Policies indicated that over 90% of workplace injury claims were handled by INAIL in 2024.

The private segment is expected to register the fastest growth over the forecast period. Private insurance is further segmented into corporate policy and retail policy. The growth of the insurance industry in Italy is primarily driven by its offering of comprehensive coverage for non-workplace accidents that could occur in a variety of settings, including during sports, travel, or at home. With increasing awareness of the risks associated with daily activities, individuals, including retail customers, employees through employer-sponsored plans, and self-employed professionals, seek protection against accidents' financial impacts. This insurance provides compensation for temporary or permanent disability and also includes daily indemnity coverage, surgery benefits, and assistance services. Major insurers such as Generali, Allianz, UnipolSai, Reale Mutua, and AXA are key players in this market, offering tailored policies that meet the diverse needs of consumers and drivers alike.

For instance, below is the product offered by Intesa Sanpaolo, a private insurer:

Product/Service

Coverage Details

Average Premium (USD)

Target Client

XME Protezione Infortuni (Main personal accident insurance)

- Coverage for death and permanent disability due to accidents

- Daily hospital allowance due to accident-related hospitalization

- Reimbursement of medical expenses (first aid, diagnostics, physiotherapy)

- Optional: Extensions for fractures, burns, and family protection

USD 150-280 (depending on selected modules and coverage limits)

- Families

- Individual clients

- Working professionals

- Self-employed individuals seeking comprehensive personal accident cover

Moreover, government initiatives promoting safety and reducing accident rates contribute to an environment where private insurance becomes increasingly relevant. This combination of factors is expected to sustain robust growth in the market.

Policy Type Insights

The corporate policy segment dominated the market in 2024 due to the growing awareness among employers that employee well-being and workplace safety is becoming increasingly significant. As organizations aim to attract and retain talent, offering comprehensive benefits packages that include accident insurance has emerged as a competitive advantage. In addition, stricter occupational health and safety regulations in many countries are prompting businesses to adopt these policies to reduce liability and ensure compliance. Furthermore, the growth of high-risk industries, such as construction, manufacturing, and logistics, has increased the demand for accident coverage. This trend is particularly evident in emerging economies, where rapid industrialization and urbanization have amplified the need for employee protection.

The retail policy segment is anticipated to register the fastest growth over the forecast period. The rapid growth of e-commerce and digital retail platforms has significantly increased the demand for insurance and policy solutions tailored to retailers. This is particularly for the policies addressing cyber risk, supply chain disruptions, and consumer liability. In addition, evolving consumer behavior post-pandemic has led to a shift towards more personalized shopping experiences and subscription-based retail models. Therefore, there is a need for customized retail policies to manage these new operational risks. For instance, online marketplaces are adopting dynamic pricing strategies and inventory insurance to protect against fluctuating demand and logistical challenges. Moreover, advancements in technology, such as AI-driven risk assessment and blockchain for transparent claims processing, have made retail policy offerings more attractive and efficient.

Key Italy Accident Insurance Company Insights

The private accident insurance sector is considerably fragmented. Notable insurers in this segment include Generali Italia SpA, one of the prominent insurance groups, offering diverse and comprehensive accident insurance products tailored to various customer segments. Lonpac leading player holds a substantial market share primarily among civil servants and high-income individuals. Other prominent private insurers, including AXA Assicurazioni SpA, Intesa Sanpaolo, all competing by offering flexible, personalized coverage and enhanced customer experience

Key Italy Accident Insurance Companies:

- Generali Italia SpA

- Allianz S.P.A.

- Intesa Sanpaolo

- Poste Assicura SpA

- AXA Assicurazioni SpA

- Reale Mutua Assicurazi

- UnipolSai Assicurazioni

- Cigna Healthcare

- Alleanza Assicurazioni SpA

Recent Developments

-

In March 2025, Generali Italia SpA completed its takeover of its Chinese Property and Casualty (P&C) insurance unit, Generali China Insurance Company Limited (GCI), marking a significant milestone in its expansion strategy in China. The transaction aligns with Generali's 'Lifetime Partner24: Driving Growth' strategy, strengthening its position in key Asian markets

-

In June 2024, Ardonagh finalized the acquisitions of Italian insurance brokerage firms Mediass S.p.A. and Mansutti S.r.l. These acquisitions bring a combined customer base of approximately 128,000 clients and add nearly 60 employees to Ardonagh’s operations, positioning Ardonagh Italia among the top ten insurance brokers in Italy.

“The completion of Mediass and Mansutti S.r.l. deals heralds the arrival of Ardonagh Italia into the top ten brokers of size in Italy. This newly enhanced Italian outfit is reflective of Ardonagh’s commitment to building in-country platforms across Europe that are powered by best-in-class talent with deeply entrenched relationships with clients and partners.”

- Conor Brennan, Executive Chairman, Ardonagh Global Partners.

Italy Accident Insurance in Terms of GWP Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.04 billion

Growth rate

CAGR of 2.58% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type, policy type

Country scope

Italy

Key companies profiled

Generali Italia SpA; Allianz S.P.A.; Intesa Sanpaolo; Poste Assicura SpA; AXA Assicurazioni SpA; Reale Mutua Assicurazioni; UnipolSai Assicurazioni; Cigna Healthcare; Alleanza Assicurazioni SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Accident Insurance in Terms of NBP Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.30 billion

Growth rate

CAGR of 1.13% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type, policy type

Country scope

Italy

Key companies profiled

Generali Italia SpA; Allianz S.P.A.; Intesa Sanpaolo; Poste Assicura SpA; AXA Assicurazioni SpA; Reale Mutua Assicurazioni; UnipolSai Assicurazioni; Cigna Healthcare; Alleanza Assicurazioni SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Accident Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Italy accident insurance market report on the basis of insurance type and policy type:

-

Insurance Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Italy Accident Insurance Market {Gross Written Premiums (GWP)}

-

Public

-

By Policy Type

-

Corporate Policy

-

Retail Policy

-

-

-

Private

- By Policy Type

- Corporate Policy

- Retail Policy

- By Policy Type

-

-

Italy Accident Insurance Market {New Business Premiums (NBP)}

-

Public

-

Private

-

-

-

Policy Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corporate Policy

-

Retail Policy

-

Frequently Asked Questions About This Report

b. The Italy health insurance market size was estimated at USD 17.22 billion in 2024.

b. The Italy health insurance market is expected to grow at a compound annual growth rate of 2.58% from 2025 to 2030, reaching USD 20.04 billion in 2030.

b. The public segment dominated the market in 2024 and accounted for the largest revenue share of 78.05% in 2024. As demand for healthcare services increases due to aging demographics, the public segment remains the backbone of Italy's health insurance framework.

b. Some key players operating in the Italy health insurance market include Generali Italia SpA, Allianz S.P.A., Intesa Sanpaolo, Poste Assicura SpA, AXA Assicurazioni SpA, Reale Mutua Assicurazioni, UnipolSai Assicurazioni, Cigna Healthcare, Alleanza Assicurazioni SpA.

b. Key factors driving market growth include changing demographics, economic conditions, and consumer awareness. In Italy, increasing healthcare costs are driving up the demand for both public and private health insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."