- Home

- »

- Next Generation Technologies

- »

-

Industrial Metrology Market Size, Industry Report, 2030GVR Report cover

![Industrial Metrology Market Size, Share & Trends Report]()

Industrial Metrology Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Reverse Engineering, Mapping & Modeling, Quality Control & Inspection), By Equipment, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-591-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Industrial Metrology Market Size & Trends

The global industrial metrology market size was estimated at USD 13.27 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. This growth is largely fueled by the increasing need for precision in smart manufacturing environments.

Key Highlights:

- The North America industrial metrology market held a significant global share of over 45% in 2024.

- The U.S. industrial metrology market dominated the North American region with a share of 67% in 2024.

- By offering, the hardware segment leads the market with a revenue share of over 59% in 2024.

- By equipment, the optical digitizer and scanner (ODS) segment held the highest share in 2024.

- By application, the reverse engineering segment accounted for the largest share in 2024.

As manufacturers embrace automation, digital twins, and real-time quality monitoring, metrology tools have become essential for maintaining dimensional accuracy and optimizing process efficiency. Industries such as aerospace, automotive, and electronics are particularly reliant on advanced technologies like high-resolution scanners and computed tomography systems to ensure product compliance.

This rising reliance on cutting-edge inspection solutions is solidifying industrial metrology’s position as a key enabler of productivity and operational excellence, driving the market’s continued expansion.

The growing complexity of components in sectors such as aerospace, electronics, and medical devices is driving increased demand for non-contact measurement within the industrial metrology industry. Laser scanners and optical systems provide fast, accurate, and damage-free inspection, making them ideal for fragile, small, or intricately shaped parts where traditional contact methods are insufficient. The precision and speed of non-contact systems are rapidly establishing them as essential tools in modern quality control processes.

3D scanning technologies are gaining significant traction in the industrial metrology industry as manufacturers seek efficient methods to capture accurate data for reverse engineering, prototyping, and inspection. The high-fidelity digitization of parts supports digital twin initiatives and shortens product development cycles. Industries like automotive and construction are leveraging 3D scanning to accelerate innovation, reinforcing metrology’s role in comprehensive product lifecycle management.

Cloud computing is emerging as a crucial enabler within the industrial metrology industry, facilitating remote measurement, centralized data management, and cross-facility collaboration. Manufacturers are adopting cloud-based metrology software to streamline operations and integrate metrology into broader global digital platforms. This shift enhances scalability, improves version control, and provides real-time visibility into quality metrics, transforming metrology into a connected, enterprise-level solution.

The rise of 3D printing is fueling demand in the industrial metrology industry for solutions capable of validating complex internal geometries and unconventional part designs. Computed tomography (CT) scanning and high-resolution 3D scanning technologies are enabling effective inspection of additive manufacturing components. As additive manufacturing advances into high-value production, the need for reliable measurement grows, driving innovation in inspection tools tailored to additive workflows.

Industries with strict quality standards-such as aerospace, automotive, and medical devices-are increasingly relying on the industrial metrology industry to meet compliance requirements. Automated data capture and audit-ready documentation are essential for adhering to international regulations. This regulatory pressure is accelerating the adoption of advanced metrology systems across supply chains, positioning metrology as a strategic enabler of certification, traceability, and quality assurance.

Offering Insights

The hardware segment dominated the market with a revenue share of over 59% in 2024, due to rising demand for high-precision, fast-processing metrology systems. Manufacturers are increasingly investing in advanced Coordinate Measuring Machines (CMMs), optical scanners, and laser trackers to meet the needs of high-throughput environments. Hardware innovations are focused on improving accuracy, speed, and versatility to support complex geometries and materials across aerospace, automotive, and semiconductor sectors. This drive toward enhanced measurement performance is positioning advanced metrology hardware as a key enabler of digital manufacturing transformation.

The software segment is expected to witness the fastest CAGR of over 8% from 2025 to 2030, owing to the growing emphasis on data intelligence, automation, and predictive analytics. The software segment is becoming a major driver of growth in metrology. Manufacturers are increasingly adopting advanced metrology software equipped with AI, machine learning, and real-time data processing to enhance inspection accuracy and streamline measurement workflows. These intelligent solutions enable seamless integration between metrology devices and enterprise systems, supporting closed-loop quality control across production environments. As smart manufacturing gains momentum, such software is proving essential for scalable, agile, and insight-driven metrology operations.

Equipment Insights

The optical digitizer and scanner (ODS) segment held the largest market share in 2024, driven by the need for non-contact, high-resolution 3D scanning in precision-critical industries. As product designs become more intricate, ODS technologies offer unparalleled speed and accuracy in capturing surface geometries without physical contact. This trend is particularly strong in the automotive, aerospace, and medical device sectors, where delicate or complex parts require detailed inspection. The shift toward digital twin integration and real-time quality assurance is further propelling the demand for ODS solutions in smart manufacturing environments.

The X-ray and computed tomography segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the rising demand for non-destructive inspection methods. Industries such as aerospace, automotive, and medical devices rely on these technologies to detect internal structures and hidden defects with high precision, ensuring safety and performance. Advances in CT resolution and speed are enabling quicker, more detailed inspections, reducing production delays, and enhancing quality control. In addition, the growing complexity of components, especially those made through additive manufacturing, is accelerating the adoption of X-ray and CT metrology solutions.

Application Insights

The reverse engineering segment held the largest market share in 2024. The rising demand for faster product development and extended asset lifecycles is propelling rapid growth in the segment. By creating accurate digital models of physical parts, reverse engineering allows companies to quickly prototype, redesign, and manufacture legacy components with minimal lead time. This approach is especially vital in industries such as aerospace, automotive, and heavy machinery, where original design data is often missing or obsolete. Advances in scanning technology and seamless software integration are making reverse engineering more efficient and accessible, solidifying its role as a strategic driver of innovation and cost reduction.

The quality control & inspection segment is expected to witness significant CAGR from 2025 to 2030, owing to manufacturers’ increasing focus on automation to maintain consistent product quality and minimize human error, the segment is witnessing accelerated growth. Advanced metrology systems featuring AI-driven analytics and real-time monitoring are enabling faster and more precise defect detection throughout production lines. This trend is especially evident in high-stakes industries such as automotive, aerospace, and medical devices, where precision and regulatory compliance are paramount. In addition, the integration of inspection data with enterprise resource planning (ERP) systems is further improving decision-making and boosting operational efficiency.

End-use Insights

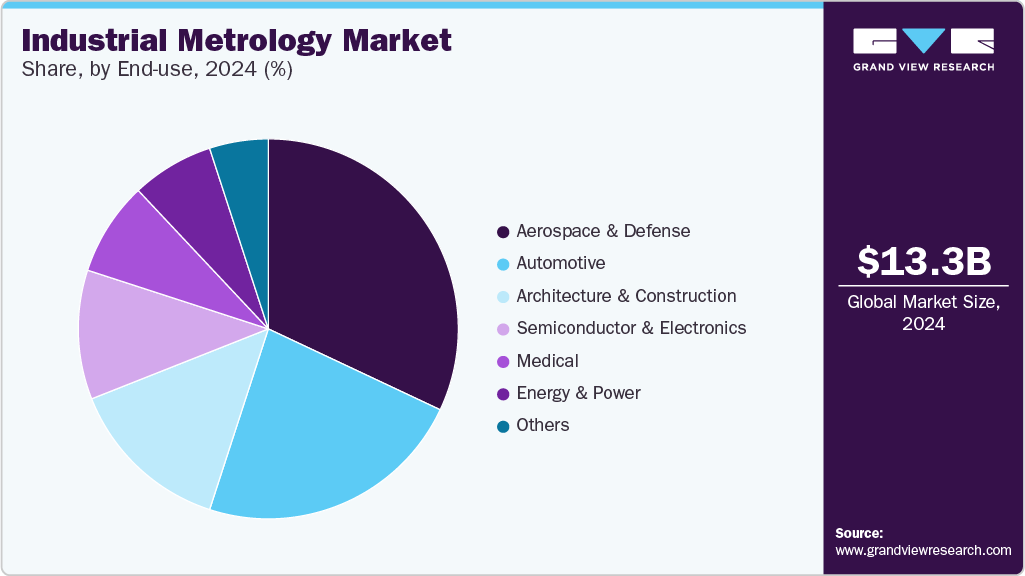

The aerospace & defense segment held the largest market share in 2024, driven by stringent safety regulations and high-quality standards that demand precise and dependable metrology solutions. Manufacturers are significantly investing in cutting-edge measurement technologies such as 3D scanning and non-destructive testing to ensure the integrity and performance of critical components. The industry’s shift toward lightweight materials and complex geometries is further fueling the need for advanced inspection methods. In addition, the growing integration of digital twins and real-time monitoring is optimizing maintenance processes and lifecycle management, solidifying this segment as a major growth driver.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2030, primarily driven by the growing demand for electric vehicles (EVs) and autonomous driving systems. The automotive segment is rapidly evolving within the market. Manufacturers are increasingly adopting advanced measurement solutions to ensure precise inspection of complex components such as battery packs, sensors, and lightweight chassis, which is critical for safety, performance, and regulatory compliance. The rise of Industry 4.0 initiatives is further accelerating the integration of metrology data with digital manufacturing platforms, enabling real-time quality assurance. This trend is fueling faster innovation cycles and higher production volumes, positioning metrology as a strategic enabler for the future of the automotive industry.

Regional Insights

The North America industrial metrology market held a significant global share of over 45% in 2024, owing to the robust presence of aerospace and automotive manufacturing hubs, North America is rapidly adopting advanced metrology solutions to enhance precision and compliance. The region’s increasing investment in Industry 4.0 technologies is driving the integration of smart metrology hardware and software for real-time quality control. Furthermore, regulatory emphasis on safety and environmental standards continues to accelerate demand for non-destructive testing and automated inspection systems.

U.S. Industrial Metrology Market Trends

The U.S. industrial metrology industry dominated the market with a share of 67% in 2024, driven by the surge in electric vehicle production and semiconductor manufacturing, the U.S. market is witnessing heightened adoption of high-accuracy metrology instruments. The push toward digital manufacturing ecosystems is fostering widespread implementation of AI-enabled metrology software for predictive quality management. In addition, government initiatives supporting advanced manufacturing innovation are reinforcing the growth trajectory for metrology solutions.

Europe Industrial Metrology Market Trends

The Europe industrial metrology industry is expected to grow at a CAGR of over 4% from 2025 to 2030, primarily driven by stringent quality regulations and sustainability targets, Europe is investing heavily in metrology technologies for precision manufacturing. The aerospace and medical device sectors are key contributors to the increasing demand for sophisticated inspection and reverse engineering tools. Moreover, the region’s focus on digitization and smart factories is encouraging the deployment of integrated metrology platforms across various industries.

The UK industrial metrology market is expected to grow at a significant rate in the coming years, owing to the UK’s growing focus on advanced manufacturing and aerospace innovation, the market for industrial metrology is expanding steadily. There is a rising trend of adopting optical digitizers and computed tomography solutions to ensure rigorous quality assurance. The nation’s strategic emphasis on digital transformation in manufacturing operations is also boosting demand for connected metrology systems.

The Germany industrial metrology market is driven by the rising demand for eco-conscious solutions, driven by Germany’s strong automotive sector and precision engineering heritage, the country leads in deploying innovative metrology hardware and software solutions. The integration of Industry 4.0 and IoT technologies in manufacturing plants is propelling real-time inspection and process optimization. Additionally, Germany’s stringent standards for product reliability and safety continue to fuel investment in automated quality control.

Asia Pacific Industrial Metrology Market Trends

The Asia Pacific industrial metrology industry is expected to grow at the fastest CAGR of over 10% from 2025 to 2030, primarily driven by rapid industrialization and the rise of electronics manufacturing, Asia Pacific is witnessing accelerated adoption of metrology technologies. The region’s growing emphasis on digital transformation and smart factory initiatives is catalyzing demand for AI-powered inspection and measurement systems. The expanding aerospace and automotive sectors in emerging economies are further contributing to market growth.

The China industrial metrology market is gaining traction, Owing to China’s massive manufacturing base and government support for advanced manufacturing technologies, the industrial metrology industry is expanding quickly. The country’s focus on improving product quality and production efficiency is driving demand for high-precision metrology hardware and software. In addition, China’s investments in semiconductor fabrication plants are bolstering the need for state-of-the-art measurement and inspection solutions.

The Japan industrial metrology market is rapidly expanding, driven by Japan’s leadership in precision manufacturing and robotics, and the demand for sophisticated metrology systems remains strong. The automotive and electronics industries are key adopters of advanced coordinate measuring machines and optical scanners. Furthermore, Japan’s commitment to innovation and quality control is fostering continuous upgrades in metrology technologies to maintain a competitive advantage.

Key Industrial Metrology Company Insights

Some of the key players operating in the market are Hexagon AB, Carl Zeiss AG, among others.

-

Hexagon AB is a leading provider of digital reality solutions, seamlessly integrating sensors, software, and autonomous technologies. The company is widely recognized for its advanced metrology hardware and software platforms that facilitate high-precision measurement and robust quality control. Its comprehensive portfolio includes coordinate measuring machines (CMMs), laser trackers, and 3D scanning systems. Hexagon’s core strength lies in delivering end-to-end metrology solutions across the automotive, aerospace, and manufacturing sectors.

-

Carl Zeiss AG, headquartered in Germany, is a distinguished technology firm specializing in high-precision optical and optoelectronic systems. The company delivers an extensive range of metrology solutions, including both coordinate and optical measurement systems, widely utilized in quality assurance and inspection processes. Zeiss is particularly noted for its capabilities in both contact and non-contact metrology, with strong market presence in the automotive and electronics industries. It excels in high-resolution measurement systems and integrated metrology solutions for industrial microscopy applications.

Creaform and AccuScan are some of the emerging market participants in the market.

-

Creaform, based in Canada, is an emerging force in the industrial metrology landscape, known for its portable 3D scanning and measurement technologies. Flagship products such as Go!SCAN and HandySCAN 3D are lauded for their intuitive operation and rapid data acquisition capabilities. The company strategically focuses on applications in reverse engineering, inspection, and quality control. Creaform’s expertise lies in delivering innovative optical 3D measurement technologies tailored to both industrial and research-driven environments.

-

AccuScan, headquartered in Ireland, is gaining traction as a notable emerging player in the industrial metrology industry. The company offers innovative scanning and measurement solutions, specifically designed to address niche requirements in industrial inspection. It is earning recognition for delivering high accuracy at competitive price points, making it especially appealing to SMEs and localized manufacturing operations. AccuScan’s specialization lies in 3D laser scanning and dimensional quality analysis technologies.

Key Industrial Metrology Companies:

The following are the leading companies in the industrial metrology market. These companies collectively hold the largest market share and dictate industry trends.

- AccuScan

- Baker Hughes Company

- Carl Zeiss AG

- Creaform

- FARO

- Hexagon AB

- JENOPTIK

- KEYENCE CORPORATION

- KLA Corporation

- Mitutoyo Corporation

- Nikon Corporation

- Nordson Corporation

Recent Developments

-

In May 2025, Sodick Co., Ltd. acquired Prima Additive, a leading provider of laser-based additive manufacturing (AM) solutions. This strategic move enhances Sodick’s capabilities in the metal 3D printing space, positioning the company to deliver integrated solutions that combine advanced manufacturing with precision quality control. The acquisition aligns with the broader market trend of merging additive manufacturing technologies with high-accuracy measurement systems to meet the increasing demand for part validation and process reliability in sectors such as aerospace, automotive, and medical devices.

-

In May 2025, PVA TePla AG announced the acquisition of DIVE Imaging Systems GmbH, a spin-off from the Fraunhofer Institute for Material and Beam Technology. DIVE specializes in advanced optical material analysis technologies, including hyperspectral imaging combined with artificial intelligence, enabling precise, non-destructive inspection of materials and components. This strategic acquisition enhances PVA TePla's metrology portfolio, strengthening its position in providing high-precision inspection solutions for industries such as semiconductors, energy, and automotive manufacturing.

-

In January 2025, Onto Innovation Inc. expanded its footprint in the semiconductor industry by securing a USD 69 million volume purchase agreement with a major DRAM manufacturer, covering its comprehensive optical metrology suite, including common films, optical critical dimension, and integrated metrology solutions. This strategic expansion reflects the increasing demand for Onto's Iris system and aligns with the projected rebound in the DRAM market. Furthermore, the company advanced its product portfolio with the launch of the Iris G2 system, a flexible platform tailored to address both common and critical film applications, positioning Onto to capture a substantial portion of the estimated $400 million critical films market in 2025.

Industrial Metrology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.08 billion

Revenue forecast in 2030

USD 18.91 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, equipment, application, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Hexagon AB; KLA Corporation; FARO; Creaform; Baker Hughes Company; Carl Zeiss AG; Mitutoyo Corporation; JENOPTIK; AccuScan; Nordson Corporation; KEYENCE CORPORATION; Nikon Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Metrology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial metrology market report based on offering, equipment, application, end-use, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Optical Digitizer and Scanner (ODS)

-

Measuring Instruments

-

X-Ray and Computed Tomography

-

Coordinate Measuring Machine (CMM)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reverse Engineering

-

Mapping and Modeling

-

Quality Control & Inspection

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Architecture & Construction

-

Medical

-

Semiconductor & Electronics

-

Energy and Power

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising adoption of advanced 3D and IoT-enabled metrology technologies, growing focus on quality control and regulatory compliance, and expansion of Industry 4.0 and 5.0 initiatives.

b. The global industrial metrology market size was estimated at USD 13.27 billion in 2024 and is expected to reach USD 14.08 billion in 2025.

b. The global industrial metrology market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 18.91 billion by 2030.

b. North America dominated the industrial metrology market with a share of over 45% in 2024. Due to the robust presence of aerospace and automotive manufacturing hubs, North America is rapidly adopting advanced metrology solutions to enhance precision and compliance.

b. Some key players operating in the industrial metrology market include Hexagon AB, KLA Corporation, FARO, Creaform, Baker Hughes Company, Carl Zeiss AG, Mitutoyo Corporation, JENOPTIK, AccuScan, Nordson Corporation, KEYENCE CORPORATION, and Nikon Corporation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."