- Home

- »

- Consumer F&B

- »

-

Energy Drinks Market Size & Share, Industry Report, 2030GVR Report cover

![Energy Drinks Market Size, Share & Trends Report]()

Energy Drinks Market Size, Share & Trends Analysis Report By Product (Energy Drinks, Energy Shorts), By Type (Organic, Conventional), By Packaging (Bottles, Cans), By Distribution Channel (On-Trade, Off-Trade), By Region, Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-951-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Energy Drinks Market Summary

The global energy drinks market size was estimated at USD 79.39 billion in 2024 and is projected to reach USD 125.11 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. Energy drinks have become increasingly popular among fitness enthusiasts and athletes due to their ability to provide a quick energy boost.

Key Market Trends & Insights

- The energy drinks market in North America accounted for a revenue share of 37.1% of the global revenue in 2024.

- The energy drinks market in the U.S. is projected to grow at a CAGR of 7.2% from 2025 to 2030.

- By product size, the energy drinks market accounted for a revenue share of 87.1% of the global revenue in 2024.

- By type, the conventional energy drinks market accounted for a revenue share of 86.3% of the global market in 2024.

- By packaging, cans energy drinks market accounted for a revenue share of 82.4% of the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 79.39 Billion

- 2030 Projected Market Size: USD 125.11 Billion

- CAGR (2025-2030): 8.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These beverages are formulated with ingredients such as caffeine, taurine, B vitamins, and amino acids that enhance physical performance and mental alertness. They have also gained traction among gamers seeking quick and convenient ways to maintain alertness and performance levels during marathon sessions and professional tournaments.

Brands are introducing energy drinks that are free of sugar and calories, catering to the demand for healthier alternatives that can benefit athletes and individuals struggling with obesity. Sugar-free options also cater to those with lactose intolerance. Energy drinks, including carbonated beverages, ready-to-drink tea, beverage concentrates, soft drinks, fruit and vegetable juices, and ready-to-drink coffee, are among the most popular choices.

Shifting consumer preferences, evolving lifestyles, changing tastes, and ongoing product innovations have fueled the demand for these beverages. Growing awareness about maintaining health drives consumers to consume energy drinks to stay hydrated, maintain proper liquid intake, and foster good health, further boosting market growth. Energy drinks are recognized as one of the fastest-growing segments in the global beverage industry, maintaining growth even during the pandemic when consumption patterns shifted significantly.

Consumer Insights for Energy Drinks

According to a study published in the World Journal of Advanced Research and Reviews in 2024, 43% of their respondents (from a sample of Nigerian youth in urban centers) consume energy drinks during study sessions or before exams. The availability of energy drinks on campuses and student-friendly marketing campaigns and promotions contribute to their widespread use among this demographic.

According to a 2023 survey by Tractor Beverage Co., 61% of the respondents think that organic products are healthier. Free from synthetic pesticides and GMOs, organic energy drinks appeal to the health-conscious demographic, driving their demand. Moreover, the preference for natural and clean-label products is on the rise. Consumers are becoming more mindful of the ingredients used in their beverages, seeking options that are minimally processed and free from artificial additives. Organic energy drinks align with this trend, offering a cleaner and more natural alternative to their conventional counterparts.

Moreover, according to a study published in BMC Public Health in 2022 studying the price elasticity of Indian consumers pertaining to sugar-sweetened beverages, for every 10% rise in the price of aerated or sugar-sweetened beverages, there is a decrease in their consumption by 9.4%. Energy drinks brands operating in India are targeting large volumes of customers with their low-price range, capitalizing on the consumers’ orientation of buying affordable beverages.

Product Insights

The energy drinks market accounted for a revenue share of 87.1% of the global revenue in 2024. Energy drinks provide an immediate increase in energy and alertness due to ingredients such as caffeine, taurine, B vitamins, and various stimulants. These drinks are distinct from energy drinks, largely due to their unique compositions and the benefits they offer, such as combating fatigue and enhancing performance. In addition, the rising preference for healthier formulations as sugar-free, low-calorie, and natural ingredient options-has broadened the consumer base beyond traditional users. The dominance of North America, with its well-established sports culture and fitness trends, also contributes significantly to the market share. Furthermore, marketing strategies emphasizing instant energy and immunity benefits attract younger demographics, sustaining high demand despite regulatory scrutiny and health concerns.

The energy shots market is projected to grow at a CAGR of 1.0% from 2025 to 2030. The growth of the energy shots segment is driven by various factors, such as the increasing demand for convenience and portability. Energy shots offer a quick and easy solution for consumers looking to boost their energy levels on the go. They are typically smaller and come in portable packaging, making them an ideal choice for consumers with busy lifestyles. In April 2024, Living Essentials Marketing, LLC, the creators of 5-hour ENERGY, unveiled a new product range targeted at the gaming community. The lineup, named Gamer Shot, has three innovative flavors designed to enhance focus and energy for gamers. These Gamer Shots are formulated with B vitamins, taurine, and amino acids, aiming to provide sustained energy and concentration without causing jitteriness or energy crashes.

Type Insights

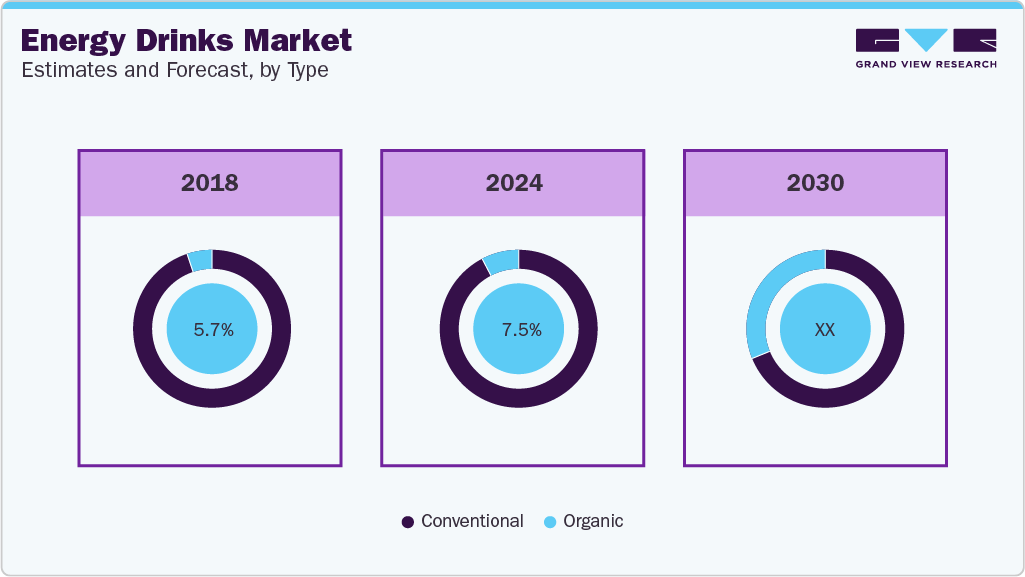

The conventional energy drinks market accounted for a revenue share of 86.3% of the global market in 2024. This segment of energy drinks is characterized by its reliance on artificial ingredients, such as synthetic caffeine, taurine, and various other additives. These energy drinks are typically formulated to provide a quick boost of energy through a combination of stimulants and sugars.

The conventional segment often appeals to consumers looking for an immediate energy kick without the emphasis on natural or organic ingredients. This segment is known for its wide availability, aggressive marketing strategies, and often lower pricing compared to organic alternatives. For instance, the Raspberry Razz 5-hour ENERGY drink by Living Essentials Marketing, LLC contains caffeine, along with B vitamins and other nutrients. It includes taurine, an amino acid. This product is sugar-free, carbohydrate-free, and has zero calories.

The organic energy drinks market is projected to grow at a CAGR of 10.3% from 2025 to 2030. The organic segment is primarily driven by consumer demand for healthier and natural beverage options. Consumers increasingly seek products free from artificial ingredients, chemicals, and pesticides.

This shift toward organic energy drinks are fueled by a growing awareness of health and wellness, along with concerns about the potential negative effects of consuming conventional energy drinks with high levels of sugar and synthetic additives. For instance, in December 2023, Wholesome Organics Co., a health food company, introduced Clean Energy Shot. It is designed for individuals looking for an organic energy enhancement with additional health benefits. It is made using a caffeine base from yerba mate and includes adaptogens such as lion’s mane, cordyceps, guarana, and ashwagandha. Clean Energy Shot is calorie-free, contains B12 vitamins, and is free from artificial flavors.

Packaging Insights

Cans energy drinks market accounted for a revenue share of 82.4% of the global market in 2024. Cans offer better preservation of the product’s taste and freshness compared to other packaging options such as cartons or pouches. Energy drinks contain various ingredients such as vitamins, minerals, and caffeine that can degrade over time when exposed to air or light. Cans provide an effective barrier against these external factors, ensuring that the product maintains its taste and quality for an extended period. In addition, cans are less susceptible to contamination from bacteria or other microorganisms compared to cartons or pouches. For instance, as per Red Bull GmbH, aluminum cans are 20% more transport-efficient than plastic containers and 40% more than glass bottles. Red Bull Coolers utilize natural refrigerants, energy-efficient fans, and smart devices for temperature and light regulation to store its product efficiently.

The bottles segment is projected to grow at a CAGR of 7.9% from 2025 to 2030. The convenience and portability of bottles make them a popular choice among consumers who lead active lifestyles or are frequently on the go. The resealable nature of bottles allows for easy consumption over multiple sittings, catering to those who prefer to consume their energy drinks gradually. Moreover, the larger surface area of bottles compared to cans provides ample space for branding and marketing efforts, making them visually appealing to consumers. For instance, in September 2022, UPTIME Energy unveiled a new bottle design at the NACS Show 2022, featuring a shorter height and wider base while retaining its resealability. This design was aimed at improving the shelf stability and display efficiency. It enhances the stability of 12-pack cartons and improves retail displays, also helping to reduce shrinkage.

Distribution Channel Insights

The sales of energy drinks through off-trade accounted for a revenue share of around 80.4% of the global revenue in 2024. The off-trade segment refers to distribution channels where products are sold for consumption outside the premises where they are purchased. These include supermarkets, convenience stores, gas stations, and online retailers. The off-trade segment is characterized by its focus on packaged products that are ready for consumption at any time and place, catering to consumers looking for convenience and accessibility. The off-trade segment targets consumers who prefer to purchase energy drinks for later consumption, to stock up at home, or for on-the-go intake.

In May 2023, WOX Energy Drinks India expanded its retail footprint through a partnership with G Town Wines, a distinguished chain known for offering a wide range of both Indian and imported liquor brands. This collaboration enabled WOX Energy Drinks to enhance product availability in multi-brand retail outlets, providing consumers with easier access to its full lineup, including the classic edition.

Energy drinks sales through the on-trade are projected to grow at a CAGR of 5.9% from 2025 to 2030. The on-trade segment in the energy drinks market refers to distribution channels where beverages are sold for immediate consumption within establishments such as bars, restaurants, clubs, and cafes. This segment is characterized by direct sales to consumers in these venues, offering a unique experience compared to off-trade channels such as supermarkets and convenience stores. Red Bull GmbH, renowned for its energy drink, holds a significant partnership with the Palladium Hotel Group.

Experimental consumption is one of the significant drivers of the on-trade distribution. In this channel, consumers often seek energy drinks as part of a social or recreational activity, looking for quick energy boosts while enjoying a night out. The ambiance and social setting of on-trade establishments play a significant role in influencing consumer choices, making it essential for brands to engage in targeted marketing strategies that resonate with this context. In October 2023, Celsius partnered with Dunkin’ Donuts and Jersey Mike’s to distribute its energy drinks across select locations in the U.S. These partnerships mark Celsius's entry into national restaurant chains.

Regional Insights

The energy drinks market in North America accounted for a revenue share of 37.1% of the global revenue in 2024. In North America, the demand for energy drinks is primarily fueled by a fast-paced lifestyle and a strong emphasis on health and wellness. Consumers in this region increasingly seek functional beverages that offer energy-boosting properties and health benefits. This has led to a rise in the popularity of natural and organic energy drinks and products with added vitamins and minerals to cater to health-conscious consumers. For instance, Vive Organic offers energy + immunity shots made with ashwagandha, ginseng, turmeric root, ginger root, lion’s mane, and green tea.

U.S. Energy Drinks Market Trends

The energy drinks market in the U.S. is projected to grow at a CAGR of 7.2% from 2025 to 2030. The U.S. market is dynamic and competitive, with the presence of well-known brands such as Red Bull, Monster Energy, and Rockstar. Active lifestyles of consumers are driving the country’s market. Consumers are drawn to energy drinks that offer functional benefits such as added vitamins, minerals, and natural ingredients. In addition, the presence of tech hubs such as Silicon Valley contributes to a culture where energy drinks are often consumed to enhance focus and productivity. In February 2024, Odyssey Wellness LLC, a functional beverage startup, secured USD 6 million in equity funding, raising the total investment to USD 14 million since its launch two years ago. The company produces energy drinks infused with 2,750 milligrams of Lion’s Mane and Cordyceps mushrooms to enhance cognitive clarity and focus.

The energy drinks market in Canada is projected to grow at a CAGR of 8.3% from 2025 to 2030, driven by the active lifestyle of residents who engage in outdoor activities such as hiking, skiing, and mountain biking. The region sees a higher consumption of energy drinks due to the presence of a younger demographic and a growing trend toward health and wellness. In January 2022, GURU Organic Energy Corp. partnered with Whistler Blackcomb, Bromont, and Mont Sutton ski resorts to offer its organic energy drinks and host promotional events during the 2022 ski season, targeting health-conscious outdoor enthusiasts.

Europe Energy Drinks Market Trends

The energy drinks market in Europe is projected to grow at a CAGR of 7.1% from 2025 to 2030. Growing consumer interest in sports, fitness, and an active lifestyle has driven the demand for energy drinks among athletes, gym-goers, and sports enthusiasts across Europe. Energy drinks are often consumed before, during, or after workouts to enhance performance, increase endurance, and aid recovery. CELSIUS, an energy drink manufacturer, markets its product as an energy drink that aids in fitness activities by boosting metabolism and keeping consumers active. Leading market players such as Red Bull, Bullit, and Power Horse Energy Drinks GmbH established Energy Drinks Europe (EDE) in 2010 to ensure consumer safety, promote responsible marketing, and represent member interests. Such strategic initiatives foster consumer trust and are expected to support the growth of the energy drinks market in the region.

The energy drinks market in the UK is projected to grow at a CAGR of 6.2% from 2025 to 2030. The rise of e-commerce platforms and online shopping has provided energy drink brands with opportunities for growth in the UK market. In 2023, the country had one of the largest e-commerce markets across the globe, and beverages are one of the top product categories in terms of demand. Brands operating in the UK leverage e-commerce channels to sell directly to consumers, bypassing traditional retail intermediaries and gaining greater control over pricing, promotions, and customer relationships.

Direct-to-consumer sales have enabled brands to reach geographically dispersed consumers, personalize marketing efforts, and gather valuable data insights for product development and marketing strategies, driving growth and innovation in the energy drinks market. In addition, brands are utilizing e-commerce companies such as Amazon and Tesco to expand their reach by leveraging their market goodwill and geographical presence.

The energy drinks market in Germany is projected to grow at a CAGR of 6.7% from 2025 to 2030. Energy drinks have gained popularity among college students, young adults, and teenagers in Germany due to the availability of diverse flavors and types, reflecting a shift toward functional beverages over traditional carbonated drinks. Moreover, energy drinks are gaining popularity in the market due to their unique and refreshing taste. According to a study published in the Catholic University of Portugal in 2022, over 70% of the sample group, which contained over 300 respondents who lived in Germany, consumed energy drinks regularly. Most regular drinkers were young adults, and the top three motivations for consumption were taste, refreshment, and enhancing concentration.

Asia Pacific Energy Drinks Market Trends

The energy drinks market in Asia Pacific is projected to grow at a CAGR of 9.7% from 2025 to 2030. Rapid urbanization across many countries in Asia Pacific has resulted in extremely busy lifestyles, wherein individuals often seek quick energy boosts to keep up with their daily activities. According to a study published by the Journal of Nutrition and Metabolism in 2022, the primary reason for consuming energy drinks is to stay awake and alert. Energy drinks provide a convenient solution for people who need a quick pick-me-up during work hours, study sessions, or social gatherings. This demographic shift toward urban living has created a favorable environment for the growth of the energy drinks market in Asia Pacific.

The energy drinks market in China accounted for a share of 41.1% of the regional revenue in 2024. Energy drinks, typically rich in caffeine and other stimulants, have gained immense popularity among consumers in China due to their convenience and ability to provide a quick energy boost. China has experienced rapid economic growth over the past few decades, significantly increasing urbanization and industrialization. This has resulted in a more hectic working lifestyle for many individuals. The pressure to succeed in a competitive environment, long working hours, and high stress levels have become common features of the modern Chinese workplace.

The energy drinks market in India is projected to grow at a CAGR of 14.6% from 2025 to 2030. The energy drinks market in India has witnessed significant growth over the past few years, with affordable brands such as Charged and Sting, owned by The Coca-Cola Company and PepsiCo, respectively, playing a crucial role in driving this expansion. These brands have successfully tapped the growing demand for convenient and accessible energy-boosting beverages. They offer energy drinks at competitive prices, making them accessible to a wider range of consumers, including students, young professionals, and individuals looking for a quick energy boost, among other benefits.

Central & South America Energy Drinks Market Trends

The energy drinks market in Central & South America is projected to grow at a CAGR of 8.6% from 2025 to 2030. The cultural preference for natural ingredients is leading to a demand for energy drinks with organic and locally-sourced components. The emphasis on natural products sets Central and South America apart from other regions where synthetic ingredients may be more common. The growing health consciousness among consumers in these areas is driving the demand for energy drinks that offer functional benefits beyond just providing a boost of energy, such as those with added vitamins, minerals, or adaptogens. In February 2023, Jack Owoc entered into an exclusive agreement with Caso & Cia, a leading distributor in Chile, to bring Bang Energy drinks to the market. This partnership makes Bang Energy products available in supermarkets, convenience stores, and gas stations nationwide.

Middle East & Africa Energy Drinks Market Trends

The energy drinks market in the Middle East & Africa is projected to grow at a CAGR of 8.2% from 2025 to 2030. The Middle East and Africa (MEA) energy drinks market is driven by increasing urbanization and changing lifestyles. As urbanization continues to rise in countries across the MEA region, there is a growing demand for convenient and on-the-go energy-boosting products, such as energy drinks. This trend is further fueled by the fast-paced lifestyles of consumers in urban areas who seek quick energy solutions to keep up with their busy schedules. In February 2020, Dubai Energy Drink initially launched its product in the hospitality sector, followed by a retail expansion in Q2 2020. It introduced a sugar-free variant sweetened with Stevia, a natural, zero-calorie sweetener.

Key Energy Drinks Company Insights

Key companies in the energy drinks market employ diverse strategies to sustain competitiveness, including continuous product innovation with new flavors and functional benefits such as low-sugar and natural ingredient options. They emphasize expanding distribution channels across retail and food service outlets to enhance accessibility and consumer reach. Marketing efforts focus on sponsorships of sports and lifestyle events, digital campaigns, and influencer collaborations to engage target demographics.

Key Energy Drinks Companies:

The following are the leading companies in the energy drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Red Bull GmbH

- Taisho Pharmaceutical Holdings Co. Ltd.

- PepsiCo, Inc.

- Monster Beverage Corporation

- Suntory Holdings Limited

- The Coca-Cola Company

- Amway Corp

- AriZona Beverages USA

- Living Essentials Marketing, LLC

- Keurig Dr Pepper, Inc

Recent Developments

-

In April 2024, GURU Organic Energy Corp., Canada's organic energy drink brand, launched Peach Mango Punch in Canada, supported by a national marketing campaign. This new drink, low in calories and rich in natural ingredients, aims to enhance focus and brain performance. It contains caffeine and plant-based ingredients and is certified organic without sucralose or aspartame. Key ingredients include L-theanine, monk fruit, and stevia, contributing to its health benefits and sweetness.

-

In March 2024, REDCON1 LLC introduced its performance energy drink, REDCON1 ENERGY, at Circle K stores worldwide. This move marked REDCON1's entry into the convenience store market, expanding the brand's accessibility to consumers.

Energy Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 85.25 billion

Revenue Forecast in 2030

USD 125.11 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain: China; Japan; India; Thailand; Australia & New Zealand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Red Bull GmbH; Taisho Pharmaceutical Holdings Co. Ltd.; PepsiCo, Inc.; Monster Beverage Corporation; Suntory Holdings Limited; The Coca-Cola Company; Amway Corp; AriZona Beverages USA; Living Essentials Marketing, LLC; Keurig Dr Pepper, Inc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Drinks Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global energy drinks market report based on product, type, packaging, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Drinks

-

Energy Shots

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The growing demand for energy drinks as a potential energy booster in order to improve physical and cognitive performance has been shaping the market growth. Market players are aggressively marketing energy drinks as functional beverages that uplift energy and alertness as well as provide a physical boost.

b. The global energy drinks market size was estimated at USD 79.39 billion in 2024 and is expected to reach USD 85.25 billion in 2025.

b. The global energy drinks market is expected to grow at a compounded growth rate of 8.0% from 2025 to 2030 to reach USD 125.11 billion by 2030.

b. The energy drinks market accounted for a share of 86.8% of the global revenue in 2024. Energy drinks provide an immediate increase in energy and alertness due to ingredients such as caffeine, taurine, B vitamins, and various stimulants.

b. Key factors that are driving the market growth include the increasing popularity among fitness enthusiasts and athletes due to their ability to provide a quick energy boost. These beverages are formulated with ingredients such as caffeine, taurine, B vitamins, and amino acids that enhance physical performance and mental alertness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."