- Home

- »

- Medical Devices

- »

-

China Kidney Preservation Market Size, Industry Report 2030GVR Report cover

![China Kidney Preservation Market Size, Share & Trends Report]()

China Kidney Preservation Market Size, Share & Trends Analysis Report By Preservation Solution (University of Wisconsin Solution, Celsior Solution), By Technique (Normothermic Machine Perfusion), By Donor Type, By End use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-618-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

China Kidney Preservation Market Trends

The China kidney preservation market size was estimated at USD 4.5 million in 2024 and is expected to grow at a CAGR of 8.02% from 2025 to 2030. Market growth is driven by various factors, including the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease. The rising demand for kidney transplantation due to the growing number of ESRD patients is also a significant driver. Furthermore, advancements in kidney preservation technologies, such as machine perfusion and static cold storage, have improved the quality of preserved kidneys, thereby increasing the success rate of transplantations. Additionally, the increasing awareness about organ donation and transplantation among the Chinese population is expected to drive the demand for kidney preservation solutions.

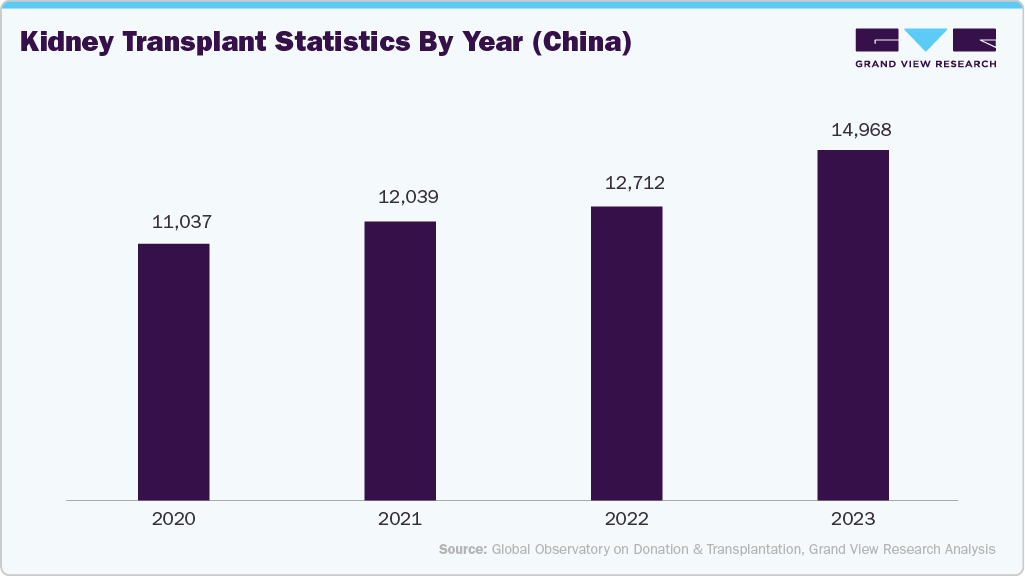

The annual number of kidney transplants in China has been increasing steadily, supported by the Ministry of Health’s efforts to create centralized organ procurement organizations (OPOs) and deploy standardized organ transportation systems. For instance, in December 2023, China's State Council issued the "Regulation on Human Organ Donation and Transplantation”. The regulation prohibits trading in human organs, ensures voluntary and unpaid donation, and restricts living organ donation to relatives. It also regulates organ removal and allocation. The new regulation aims to standardize human organ donation and transplantation in China, ensuring ethical practices and transparency. Such changes have directly increased the demand for advanced kidney preservation solutions in the country.

Similarly, the number of kidney transplants in China is witnessing a significant surge, which is expected to continue over the forecast period, increasing the demand for advanced kidney preservation solutions.

Moreover, the growth of China’s geriatric population is increasingly important in expanding the kidney preservation market. According to an official 2023 report, over one-fifth of China’s population, about 297 million people, are aged 60 or older, with 216.76 million aged 65 and above. The government is responding to this demographic shift by expanding pension insurance coverage, which now includes over 1.06 billion participants, and enhancing services for seniors through urban living circles, home-based care, and integrated medical-elderly care institutions, reflecting ongoing efforts to address the challenges of an aging society. As the demand for kidney transplants escalates alongside this demographic shift, preservation technologies become essential in ensuring optimal graft viability and utilization.

Market Concentration & Characteristics

The China kidney preservation market is characterized by developing healthcare infrastructure, a growing focus on innovation, a supportive regulatory framework, and an evolving competitive landscape. Moreover, the country's aging population and increasing awareness about kidney donation among the general population further shape the market.

China kidney preservation industry is witnessing a significant degree of innovation. There's a considerable rise in the adoption and domestic development of advanced machine perfusion (MP) technologies, including both hypothermic machine perfusion (HMP) and normothermic machine perfusion (NMP) systems. These technologies are crucial for objective viability assessment and extending preservation periods, thereby expanding the donor pool. Furthermore, the rise in focus on innovation in organ preservation can significantly drive the degree of innovation in kidney preservation in China.

The China kidney preservation industry is expected to significantly surge alliances and collaborations among key players to enhance their product offerings and expand their geographical presence. This can be attributed to the growing demand for kidney transplants and the need for advanced preservation technologies. Additionally, collaborations between industry players and hospitals can enhance the adoption of these technologies in clinical settings. Thus, partnerships and collaborations are expected to drive innovation, improve patient outcomes, and contribute to market growth in China.

The regulatory scenario in China's kidney preservation industry is complex, as the Chinese government has implemented various regulations to improve the quality and safety of organ transplantation. The National Health Commission of China has issued guidelines for organ transplantation, including kidney preservation, to standardize the process and ensure patient safety. These regulations significantly impact the kidney preservation market in China, as they influence the development, approval, and marketing of preservation solutions. The regulatory framework in China is expected to continue evolving, focusing on improving patient outcomes and promoting innovation in kidney preservation.

The threat of substitutes is a significant factor in China kidney preservation industry, as it can impact the demand for existing preservation solutions. For instance, advancements in machine perfusion technology have shown promise in improving kidney preservation outcomes, potentially substituting traditional static cold storage methods. Furthermore, research into novel preservation solutions and techniques may also emerge as substitutes for current preservation methods. The significance of the threat of substitutes lies in its potential to drive innovation and change the competitive landscape of the market.

China kidney preservation industry is witnessing significant regional expansion due to the increasing prevalence of chronic kidney diseases and a growing demand for organ transplants. This is expected to continue as the country's healthcare infrastructure improves. The expansion is driven by government initiatives to enhance organ donation and transplantation services and advancements in preservation technologies. Provinces with major medical hubs are expected to lead the growth due to their well-established healthcare systems and research institutions. Furthermore, the increasing adoption of modern preservation techniques and solutions is anticipated to further regional expansion.

Preservation Solution Insights

The University of Wisconsin (UW) Solution dominated the segment in 2024. This can be attributed to its well-established efficacy in enhancing graft survival and reducing ischemia-reperfusion injury during transplantation. Its formulation offers superior cellular protection and osmotic balance, and it is highly effective for static cold storage and hypothermic machine perfusion techniques. Additionally, the growing focus on improving transplant outcomes in China encourages clinicians and hospitals to prefer proven solutions with strong clinical data backing, significantly contributing to the adoption of the UW solution in China.

The Celsior solution is expected to grow significantly at a CAGR of 8.3% from 2025 to 2030 due to its increasing adoption in clinical and research settings. The solution offers a broad-spectrum preservation capability, supporting static cold storage and hypothermic machine perfusion, aligning with China's rising focus on improving transplant outcomes and extending organ viability. Moreover, growing awareness among Chinese transplant surgeons about the benefits of Celsior in minimizing ischemia-reperfusion injury has led to a shift from conventional solutions to more advanced options, further fueling the segment growth.

Technique Insights

Normothermic Machine Perfusion (NMP) accounted for a significant revenue share in 2024. It is expected to witness the fastest growth owing to its ability to improve organ viability and extend preservation times compared to traditional methods. China is facing a growing burden of end-stage renal disease and a significant gap between kidney demand and availability. Advanced technologies, such as NMP, address challenges by offering a longer preservation period, thereby contributing to their rising adoption. Moreover, NMP maintains the organ at physiological temperature, allowing continuous assessment of organ function, which enhances transplant outcomes and reduces the risk of delayed graft function.

Hypothermic Machine Perfusion (HMP) is expected to grow significantly over the forecast period due to its increasing clinical adoption and ability to address critical challenges in organ transplantation. As China continues to expand its national organ donation and transplant programs, the demand for advanced preservation methods that can extend organ viability and improve transplant outcomes is rising. HMP offers significant advantages over traditional preservation techniques, including better maintenance of organ quality, reduced incidence of delayed graft function, and enhanced post-transplant survival rates. These clinical benefits are driving its acceptance among transplant centers across China.

Donor Type Insights

The living donors segment dominated the market in 2024, owing to the country's regular organ shortage and the comparatively lower availability of deceased donor kidneys. Cultural and social factors, including traditional beliefs surrounding body integrity after death, contribute to a low deceased donation rate, compelling greater reliance on living donors. Additionally, living donor transplants offer clinical advantages, such as reduced ischemia times and improved graft survival rates, which align with the goals of many transplant centers to optimize outcomes. Moreover, increasing awareness about kidney donation further contributes to the rising number of living donor kidney donations, further fueling the segment growth.

Donation after Circulatory Death (DCD) is anticipated to grow fastest from 2025 to 2030 due to evolving regulatory frameworks, increasing public awareness, and growing demand for transplantable organs. As the country faces a widening gap between organ demand and availability, DCD offers an important solution by expanding the donor pool beyond traditional brain-dead donors. Moreover, government-led initiatives to improve organ donation systems and training programs for healthcare professionals in DCD protocols have increased their adoption.

End Use Insights

Transplant centers and hospitals dominated the end use segment with a revenue share of 43.5% in 2024 due to their primary role in organ transplantation procedures and access to advanced preservation technologies. As kidney transplantation is considered the most effective treatment for end-stage renal disease, specialized transplant centers have the infrastructure, trained personnel, and logistical capabilities necessary for effective organ retrieval, preservation, and transplantation. Additionally, China’s ongoing healthcare reforms and investments in tertiary care facilities have accelerated the establishment of transplant-specific units within major hospitals.

Organ Procurement Organizations (OPOs) in China are anticipated to witness the fastest growth over the forecast period due to the country’s ongoing healthcare reforms, rising demand for transplant procedures, and government-backed initiatives to improve organ donation systems. China is witnessing significant efforts to increase voluntary organ donation rates, leading to a growing number of kidneys available for transplantation. As OPOs play a central role in managing organ recovery and distribution logistics and coordination, their operational expansion aligns directly with this rising transplant demand. Moreover, the government's focus on standardizing organ procurement practices and improving cold chain infrastructure is driving the adoption of advanced kidney preservation technologies by OPOs.

Key China Kidney Preservation Company Insights

Leading market players include Shanghai Genext Medical Technology Co., Ltd., and Dr. Franz Köhler Chemie GmbH. These companies have utilized their technological expertise to enhance their presence in this growing market. Their strategies emphasize the development of effective solutions, improved accessibility, and ensuring widespread adoption of their advanced preservation solutions.

Key China Kidney Preservation Companies:

- Shanghai Genext Medical Technology Co., Ltd.

- Dr. Franz Köhler Chemie GmbH

- Bridge to Life Ltd.

- Organ Recovery Systems

- Preservation Solutions Inc.

- Institut Georges Lopez (IGL)

- Essential Pharmaceuticals LLC

- Paragonix Technologies Inc.

- TransMedics Inc.

- Global Transplant Solutions

Recent Developments

-

In October 2024, Paragonix Technologies received FDA 510(k) clearance for its KidneyVault Portable Renal Perfusion System, a device designed to preserve kidneys for transplantation. The system aims to improve kidney preservation and transplantation outcomes. The clearance enables the use of the KidneyVault system in clinical settings.

-

In August 2024, Getinge announced the acquisition of Paragonix Technologies, a company specializing in organ preservation and transportation solutions, to strengthen its presence in the transplant industry. This strategic acquisition aims to integrate Paragonix's innovative technologies, such as organ preservation devices, with Getinge's existing portfolio of products and services for the healthcare sector.

China Kidney Preservation Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 4.8 million

Revenue forecast in 2030

USD 7.1 million

Growth rate

CAGR of 8.02% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Preservation solution, technique, donor type, end use

Country scope

China

Key companies profiled

Shanghai Genext Medical Technology Co., Ltd.; Dr. Franz Köhler Chemie GmbH; Bridge to Life Ltd.; Organ Recovery Systems; Preservation Solutions Inc.; Institut Georges Lopez (IGL); Essential Pharmaceuticals LLC; Paragonix Technologies Inc.; TransMedics Inc.; Global Transplant Solutions

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to the segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Kidney Preservation Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the China kidney preservation market report based on preservation solution, technique, donor type, and end use.

-

Preservation Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

University of Wisconsin (UW)

-

Histidin-Tryptophan-Ketoglutarat (HTK) Solution

-

Celsior Solution

-

Hypertonic Citrate Adenine (HC-A) Solution

-

Institute Georges Lopez (IGL-1) Solution

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Cold Storage

-

Hypothermic Machine Perfusion

-

Normothermic Machine Perfusion

-

Other

-

-

Donor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Criteria Donor (SCD)

-

Expanded Criteria Donor (ECD)

-

Donation after Brain Death (DBD)

-

Donation after Circulatory Death (DCD)

-

Living Donor

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transplant Centers / Hospitals

-

Organ Procurement Organizations (OPOs)

-

Others

-

Frequently Asked Questions About This Report

b. The China kidney preservation market size was estimated at USD 4.5 million in 2024 and is expected to reach USD 4.8 million in 2025.

b. The China kidney preservation market is expected to grow at a compound annual growth rate of 8.02% from 2025 to 2030 to reach USD 7.1 million by 2030.

b. The University of Wisconsin (UW) Solution dominated the segment with a market share of 75.2% in 2024. This can be attributed to its well-established efficacy in enhancing graft survival and reducing ischemia-reperfusion injury during transplantation

b. Some key players operating in the China kidney preservation market include Shanghai Genext Medical Technology Co., Ltd.; Dr. Franz Köhler Chemie GmbH; Bridge to Life Ltd.; Organ Recovery Systems; Preservation Solutions Inc.; Institut Georges Lopez (IGL); Essential Pharmaceuticals LLC; Paragonix Technologies Inc.; TransMedics Inc.; Global Transplant Solutions

b. Key factors that are driving the market growth include the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease. The rising demand for kidney transplantation due to the growing number of ESRD patients is also a significant driver. Additionally, the increasing awareness about organ donation and transplantation among the Chinese population is expected to drive the demand for kidney preservation solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."