- Home

- »

- Homecare & Decor

- »

-

Blinds And Shades Market Size, Share, Industry Report 2030GVR Report cover

![Blinds And Shades Market Size, Share & Trends Report]()

Blinds And Shades Market Size, Share & Trends Analysis Report By Product (Blinds, Shades), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Installation, By Technology, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-066-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Blinds And Shades Market Summary

The global blinds and shades market size was estimated at USD 14.82 billion in 2024 and is projected to reach USD 24.63 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The market growth is driven by the increasing demand for energy-efficient window treatments, rising adoption of smart and automated blinds in residential and commercial buildings, and heightened renovation activities across aging infrastructure.

Key Market Trends & Insights

- North America blinds and shades market accounted for a share of 39.25% of the global revenue in 2024.

- The blinds and shades market in the U.S. is expected to grow at a CAGR of 8.2% from 2025 to 2030.

- By product, the blinds accounted for the largest revenue share of over 58% in 2024.

- By application, the blinds and shades sales in residential applications accounted for a share of over 55% in 2024.

- By installation, the retrofit installations accounted for a revenue share of over 57% of the global blinds and shades industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.82 Billion

- 2030 Projected Market Size: USD 24.63 Billion

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, regulatory emphasis on sustainable building practices and growing consumer preference for customizable and aesthetically appealing window coverings are contributing to market expansion. The surge in home improvement projects, alongside changing consumer lifestyles, has expanded the market for blinds and shades. Consumers are seeking window treatments that not only enhance the aesthetic appeal of their spaces but also offer functionality. The availability of a wide range of designs, materials, and customization options caters to diverse consumer preferences.The expansion of the industry is anticipated to be boosted by an increase in the construction of residential and commercial buildings. The need for blinds and shades is fueled by rapid urbanization and an increase in people's living standards. According to World Urbanization Prospect projections, 66% of the population would reside in urban and municipal areas by 2050, up from about 54% in 2014, which will increase demand for blinds and shades.

Blinds and shades play a crucial role in enhancing energy efficiency by reducing heat gain in summer and heat loss in winter. For instance, cellular shades can trap air within their layers, providing insulation and leading to lower energy costs. With rising energy costs and a growing focus on sustainability, both homeowners and businesses are increasingly adopting window treatments that contribute to energy conservation.

Consumer Insights

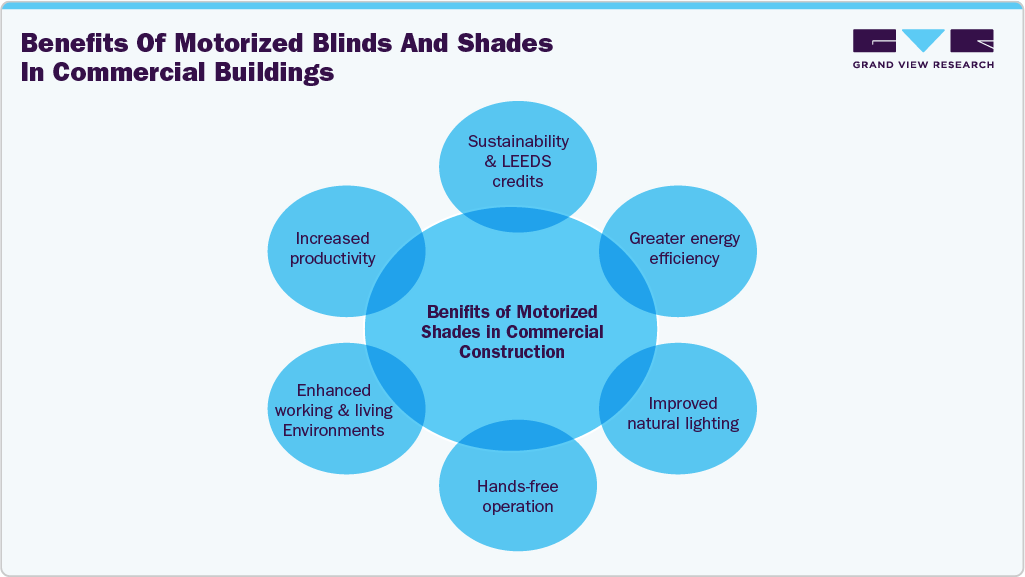

Consumer preference for motorized solar shades in commercial buildings is rapidly growing, driven by a combination of sustainability goals, energy efficiency needs, and improved occupant comfort. These automated shades are especially popular among projects targeting LEED certification, as they effectively manage glare and solar heat gain while allowing optimal natural light, key components in green building design. Unlike traditional coverings, motorized solar shades adjust automatically throughout the day using advanced daylight sensor systems, responding to changing UV levels to maintain visual comfort and thermal balance without manual intervention.

Motorized solar shades crafted from high-quality solar fabrics not only block up to 99% of harmful UV rays but also protect furnishings and interior finishes from fading, making them a smart investment for long-term facility management. According to data from the USGBC, the integration of such automated systems contributes to overall energy savings of up to 20-25% in HVAC loads, aligning well with the rising demand for energy-resilient buildings. This has made motorized shades a go-to solution for schools, hospitals, offices, and government buildings seeking both aesthetic value and performance.

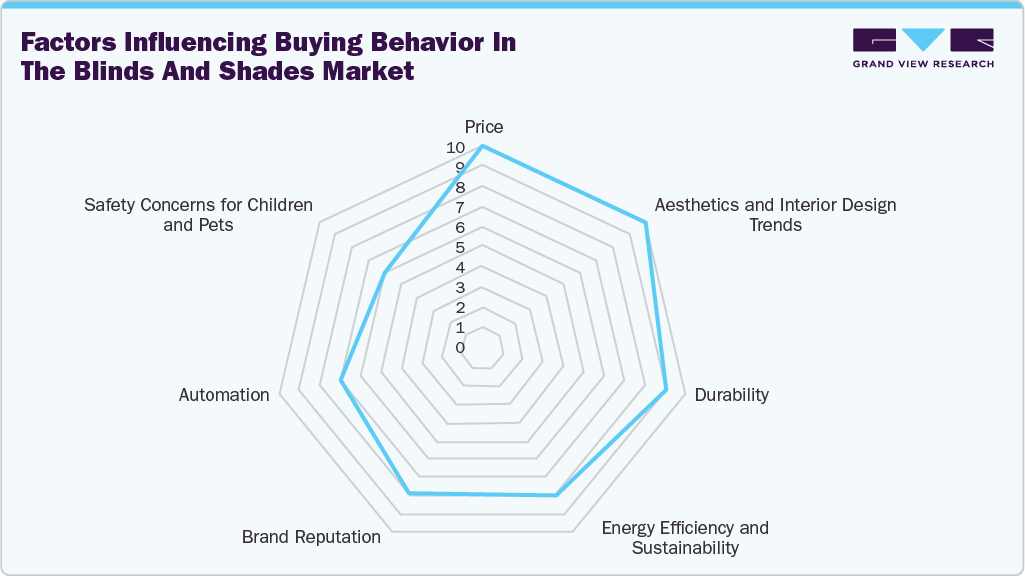

Consumer purchasing decisions in the blinds and shades market are shaped by a combination of safety, functionality, aesthetics, and sustainability. Safety is a top priority, particularly for households with children or pets-cordless window coverings are now widely preferred. According to a national survey conducted by the Window Covering Safety Council (WCSC) in February 2021, 86% of U.S. adults are aware of the strangulation hazards posed by corded window coverings. This heightened awareness, combined with regulatory changes-such as the 2018 safety standard mandating that over 80% of window coverings sold in the U.S. be cordless or have inaccessible cords-has driven demand for safer alternatives. Products labeled “Best for Kids” are becoming a key consumer consideration.

Product Insights

Blinds accounted for the largest revenue share of over 58% in 2024. Blinds, particularly Venetian, vertical, and mini-blinds, are preferred in both residential and commercial spaces for their precise light control, ease of maintenance, and compatibility with various window sizes. Their dominance is also supported by strong uptake in office buildings, educational institutions, and healthcare facilities, where light modulation and privacy are crucial.

Shades are projected to grow at a CAGR of 9.6% from 2025 to 2030, outpacing blinds in terms of growth due to rising consumer interest in modern, minimalist interiors and energy-efficient solutions. Shades, especially cellular and roller variants, offer superior insulation properties that help reduce HVAC loads-a key consideration in green building designs. According to a report by the Window Covering Manufacturers Association (WCMA), demand for cellular shades has surged due to their ability to trap air and regulate indoor temperature, making them increasingly popular in energy-conscious households and LEED-certified buildings.

Application Insights

Blinds and shades sales in residential applications accounted for a share of over 55% in 2024, primarily driven by a surge in home renovations, rising housing starts, and increased focus on interior aesthetics and energy efficiency. According to the U.S. Census Bureau, privately-owned housing starts reached approximately 1.42 million units in 2024, reflecting strong construction momentum. Additionally, the 2024 U.S. Houzz & Home Study reported that nearly 55% of homeowners undertook renovation projects, with window upgrades among the top improvements for enhancing light control, privacy, and thermal performance.

Commercial applications are projected to grow at a CAGR of 9.1% from 2025 to 2030. This is primarily attributed to rising construction activities in the commercial real estate sector. The expansion of office spaces, retail complexes, and hospitality establishments directly boosts the need for durable, functional, and aesthetically pleasing window coverings. Sustainability trends also play a crucial role as energy efficiency becomes a priority for commercial buildings. Automated and motorized blinds, designed to regulate heat and light, help in reducing energy consumption, aligning with LEED (Leadership in Energy and Environmental Design) certification goals and other green building standards.

Installation Insights

Retrofit installations accounted for a revenue share of over 57% of the global blinds and shades industry in 2024 due to growing demand for upgrading existing commercial and residential spaces. Retrofit installations benefit from widespread urban renovation projects and the increasing desire to improve energy efficiency without full-scale window replacements.Additionally, the aging building stock in key markets like North America and Europe drives retrofit demand; with over 40% of buildings constructed before 1980, there is a large base ripe for modernization.

The revenue from installations in new construction is expected to grow at a CAGR of 8.7% from 2025 and 2030.As the real estate industry continues to expand, particularly in urban areas, architects and builders prioritize energy efficiency, aesthetics, and functionality in their designs. According to Hotel Dive, a digital publication related to the hospitality industry, as of 2024, there are 157,713 hotel rooms in construction, reflecting a 5.5% increase from the previous year in the U.S.

Technology Insights

Manual blinds and shades continue to dominate the blinds and shades industry with a revenue share of 89.80% in 2024. Manual blinds and shades remain a staple in households and commercial buildings, providing homeowners with a practical and cost-effective solution for controlling light and privacy. These traditional window treatments come in various materials, styles, and colors, allowing for a wide range of customization to match any home decor.

Automatic blinds and shades are expected to witness the fastest growth, with a CAGR of 10.5% from 2025 and 2030. Automated and motorized blinds and shades have gained significant popularity in the residential sector, offering homeowners enhanced convenience, energy efficiency, and security. These smart window treatments can be controlled remotely through mobile apps or integrated with home automation systems, allowing users to adjust lighting and privacy settings with ease. By utilizing sensors, these products can automatically open or close based on sunlight exposure, contributing to energy savings by regulating indoor temperatures.

Distribution Channel Insights

Offline sales accounted for a share of 83.85% in 2024, largely due to the tactile and consultative nature of the purchase process. Consumers typically prefer to see, touch, and evaluate window covering materials in person, especially when customizing for fit, fabric, color, and functionality. Physical retail outlets, including home improvement chains like Home Depot and Lowe’s, and specialized design showrooms, offer expert guidance, on-site measurements, and installation services-factors that heavily influence consumer decisions for high-ticket, semi-permanent products like blinds and shades.

Online sales are projected to grow at a CAGR of 9.7% from 2025 to 2030, owing to the rising digital adoption, improved virtual visualization tools, and the growing DIY segment. E-commerce platforms like Blinds.com, Wayfair, and Amazon are increasingly offering advanced configurators, free samples, and customer reviews to build buyer confidence. Younger demographics, particularly millennials and Gen Z, are more inclined to explore smart blinds and shades online, drawn by discounts, ease of comparison, and tech-enabled customization.

Regional Insights

North America blinds and shades market accounted for a share of 39.25% of the global revenue in 2024, driven by strong demand for energy-efficient window treatments and smart home integration. The U.S. and Canada lead adoption due to stringent energy codes like the U.S. Department of Energy’s ENERGY STAR program, which incentivizes efficient window coverings to reduce heating and cooling costs. North American consumers increasingly prefer automated blinds and shades compatible with smart home ecosystems such as Amazon Alexa and Google Home.

U.S. Blinds And Shades Market Trends

The blinds and shades market in the U.S. is expected to grow at a CAGR of 8.2% from 2025 to 2030, driven by accelerating smart technology adoption and rising renovation expenditures. Post-pandemic trends show a surge in home improvement investments; the Joint Center for Housing Studies of Harvard University reported a 12% increase in remodeling spending in 2023. This suggests a growing demand for modern, automated window treatments that enhance convenience, privacy, and energy savings.

Europe Blinds And Shades Market Trends

The blinds and shades market in Europe accounted for a share of over 32% of the global market revenue in 2024 owing to strict environmental regulations and historic architecture preservation. The European Union’s Energy Performance of Buildings Directive (EPBD) mandates energy-efficient window coverings, promoting widespread adoption in both new and existing buildings. Furthermore, Europe’s large stock of heritage buildings creates demand for customizable, non-intrusive shading solutions that maintain aesthetic integrity while improving thermal performance.

Asia Pacific Blinds And Shades Market Trends

The blinds and shades market in Asia Pacific is expected to grow at a CAGR of 11.2% from 2025 to 2030. This is attributed to rapid urbanization, rising disposable incomes, and growing awareness of indoor environmental quality. Emerging economies such as China, India, and Southeast Asian countries are witnessing a construction boom in residential and commercial real estate, boosting demand for modern window treatments. Additionally, expanding middle-class populations with higher aesthetic and comfort expectations are fueling growth. International brands are partnering with local distributors to tailor products for regional preferences, further strengthening the blinds and shades market expansion.

Key Blinds And Shades Companies Insights

Key players operating in the blinds and shades market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Blinds And Shades Companies:

The following are the leading companies in the blinds and shades market. These companies collectively hold the largest market share and dictate industry trends.

- Hunter Douglas

- Springs Window Fashions

- Hillarys

- Aspect Blinds

- Aluvert Blinds

- Kresta

- AWB - Advanced Window Blinds

- Elite Window Fashions

- Canadian Blind Manufacturing Inc.

- Next Day Blinds Corporation

- Day Blinds LLC

Recent Developments

-

In July 2024, SelectBlinds, a leading online retailer of independently branded window fashions, and LEVOLOR, a key player in the U.S. commercial window coverings market, collaborated on drapes and window coverings in U.S. commercial spaces. This partnership resulted in the introduction of the LEVOLOR x Select collection, which features over 40 curated fabrics across multiple product categories, including drapery, Roman shades, roller shades, and woven wood shades.

-

In January 2023, Hunter Douglas, the top producer of bespoke window coverings in the world, announced that buyers may benefit from savings of up to USD 1,200 on qualified Hunter Douglas Duette Honeycomb Shades as part of the federal tax credit that encourages the purchase of energy-efficient goods.

-

On March 21, 2022, SelectBlinds.com launched two Motorized Architect Roller Shades products, with new Eve MotionBlinds and Apple HomeKit technology. The Eve MotionBlinds motors are connected blinds and shades motors that enable thread smart home technologies in addition to Bluetooth functionality.

Blinds And Shades Market Report Scope

Report Attribute

Details

Market size in 2025

USD 15.94 billion

Revenue forecast in 2030

USD 24.63 billion

Growth rate (revenue)

CAGR of 9.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast

2025 - 2030

Quantitative units

Volume, million sq. ft; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, installation, technology, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; New Zealand; Brazil; Argentina; Turkey; UAE; South Africa

Key companies profiled

Hunter Douglas; Springs Window Fashions; Hillarys; Aspect Blinds; Aluvert Blinds; Kresta; AWB - Advanced Window Blinds; Elite Window Fashions; Canadian Blind Manufacturing Inc.; Next Day Blinds Corporation; Day Blinds LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blinds And Shades Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blinds and shades market report on the basis of product, application, distribution channel, installation, technology, and region.

-

Product Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Blinds

-

Venetian

-

Vertical

-

Roller

-

Others

-

-

Shades

-

Cellular

-

Roman

-

Pleated

-

Roller

-

Others

-

-

-

Application Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Multi Brand Stores

-

-

-

Installation Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofit

-

-

Technology Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

-

Regional Outlook (Volume, Million Sq. Ft; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. North America dominated the blinds and shades market with a share of around 40% in 2022. This is owing to rapidly expanding commercial and residential construction activities that drive the demand for the blinds and shades market, and rising home improvement projects undertaken by consumers in the region.

b. Some key players operating in the blinds and shades market include Hunter Douglas, Springs Window Fashions, Hillarys, Aspect Blinds, Aluvert Blinds, Kresta, AWB - Advanced Window Blinds, Elite Window Fashions, Canadian Blind Manufacturing Inc., Next Day Blinds Corporation, and Day Blinds LLC.

b. Key factors that are driving the blinds and shades market growth include the growing expenditure on interior decoration, rapid urbanization has increased the number of households, The growing interest of individuals and professional designers in window blinds and shades coupled with the increasing inclination toward motorized and automated window blinds and shades market.

b. The Germany blinds and shades market was estimated at USD 1.00 billion in 2022 and is expected to reach USD 1.06 billion in 2023.

b. The China blinds and shades market was estimated at USD 596.7 million in 2022 and is expected to reach USD 638.6 million in 2023.

b. The gllobal blinds and shades market was estimated at USD 13.09 billion in 2022 and is expected to reach USD 13.83 billion in 2023.

b. The global blinds and shades market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 24.63 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."