- Home

- »

- Automotive & Transportation

- »

-

Automotive Engine Management System Market Report, 2030GVR Report cover

![Automotive Engine Management System Market Size, Share & Trends Report]()

Automotive Engine Management System Market Size, Share & Trends Analysis Report By Component (Electronic Control Unit, Sensors), By Engine Type (Gasoline, Diesel, Hybrid, Electric), By Vehicle Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-608-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Automotive Engine Management System Market Summary

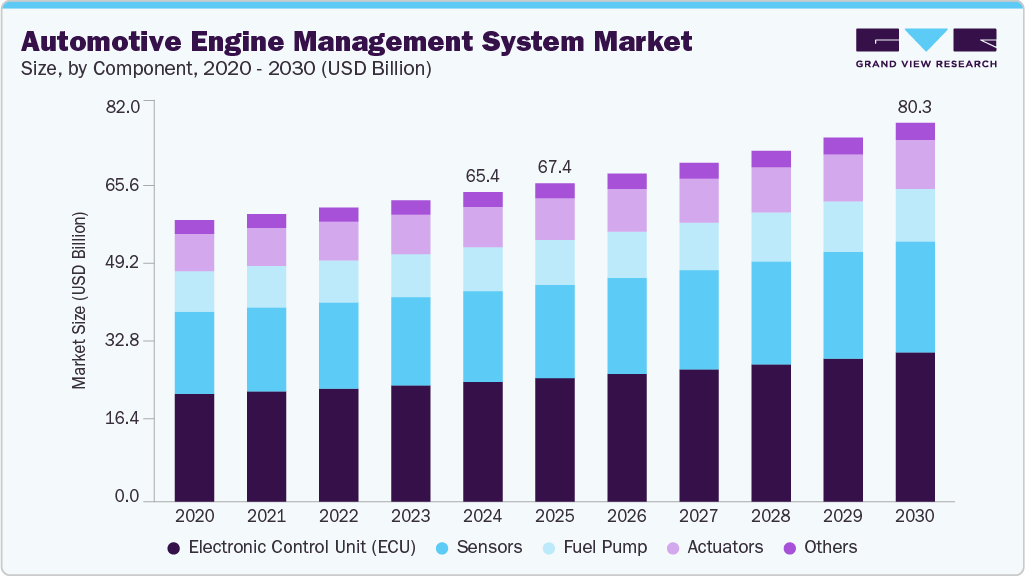

The global automotive engine management system market size was estimated at USD 65.54 billion in 2024 and is projected to reach USD 80.25 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Modern engine management systems are increasingly designed to accommodate renewable and alternative fuels, a shift driven by the need to reduce greenhouse gas emissions and dependence on fossil fuels, which boosts the market growth.

Key Market Trends & Insights

- The Asia Pacific automotive engine management system market accounted for a largest revenue share of 43.8% in 2024.

- The U.S. automotive engine management system industry held a dominant position in 2024.

- By component, the electronic control unit (ECU) segment accounted for the largest revenue share of 38.7% in 2024.

- By engine type, the gasoline engines segment held the largest share of the automotive engine management system industry in 2024.

- By vehicle type, the passenger cars segment dominated the automotive engine management system market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 65.54 Billion

- 2030 Projected Market Size: USD 80.25 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

The U.S. Department of Energy emphasizes that internal combustion engines (ICEs) can operate on fuels such as natural gas, propane, biodiesel, and ethanol without significant modifications to existing infrastructure.For instance, hydrogen combustion engines represent a pivotal innovation, with Sandia National Laboratories demonstrating that hydrogen-powered ICEs achieve 50% fuel-to-electricity efficiency while producing near-zero nitrogen oxide (NOx) emissions. This capability positions hydrogen as a viable transitional fuel for hybrid vehicles and stationary power applications. The adaptability of EMS to diverse fuel chemistries is critical for enabling a carbon-neutral future. Research under the Advanced Combustion Engines subprogram focuses on co-optimizing engine designs with fuel properties, ensuring optimal combustion dynamics for both conventional and alternative fuels. For example, ethanol’s high octane rating allows for higher compression ratios in spark-ignition engines, improving thermal efficiency by 10-15% compared to gasoline. Such advancements underscore the EMS’s role in bridging the gap between existing ICE architectures and future renewable fuel ecosystems.

The integration of hybrid electric powertrains with advanced EMS has emerged as a cornerstone strategy for improving fuel economy and reducing emissions. DOE studies reveal that combining internal combustion engines with hybrid electric systems can enhance fuel efficiency by 25-50%, depending on vehicle class and driving conditions. A notable instance is the Plug-in Hybrid Electric Vehicle (PHEV) initiative, where Oak Ridge National Laboratory developed engine control strategies to minimize cold-start emissions, a persistent challenge in hybrid systems.

By decoupling engine operation from immediate driver demand, series hybrid configurations enable optimized warm-up cycles, reducing hydrocarbon emissions by 45% during cold starts. Furthermore, the application of synergistic technologies, such as engine downsizing and turbocharging, allows manufacturers to maintain performance while reducing displacement. Ricardo’s roadmap for gasoline engine efficiency highlights that downsizing a 2.0L engine to 1.4L, coupled with direct injection and variable valve timing, can improve fuel economy by 20% without sacrificing power output. These advancements rely on EMS algorithms that dynamically adjust air-fuel ratios, ignition timing, and boost pressure to balance efficiency and drivability.

The pursuit of higher engine efficiencies propelled the market growth, which necessitates materials capable of withstanding extreme temperatures and pressures. DOE’s Vehicle Technologies Office (VTO) identifies lightweight alloys and advanced ceramics as critical enablers for next-generation engines, with the potential to save 5 billion gallons of fuel annually by 2030 if deployed across 25% of the U.S. fleet. For instance, silicon carbide (SiC) coatings on piston crowns and cylinder liners reduce heat loss, enabling combustion temperatures exceeding 1,500°C, a 15% improvement in thermal efficiency over conventional aluminum components. Heavy-duty engines benefit similarly from iron-based cast alloys with enhanced fatigue resistance, allowing higher peak cylinder pressures in diesel engines. The Materials Genome Initiative has accelerated the development of these materials through computational modeling, reducing prototyping cycles by 40%. Such innovations are integral to achieving the DOE’s target of 55% brake thermal efficiency for heavy-duty engines by 2030, up from the current 45% baseline.

The DOE’s co-optimization initiative represents a paradigm shift in EMS design, where fuel formulations and engine architectures are developed in tandem. This approach leverages the interplay between fuel chemistry and combustion dynamics to maximize efficiency. For example, gasoline compression ignition (GCI) engines, a focus of Argonne National Laboratory, utilize low-octane fuels to enable lean-burn combustion, achieving 35% higher fuel economy compared to conventional spark-ignition engines.

Similarly, the Combustion Research Facility at Sandia National Laboratories has demonstrated that tailored fuel blends, such as di-methyl ether (DME) mixed with diesel, reduce soot formation by 90% while maintaining ignition stability. These breakthroughs rely on EMS capabilities to adjust injection timing and pressure in real-time, ensuring optimal combustion phasing across diverse fuel mixtures. The DOE estimates that co-optimization could yield a 10% efficiency gain in light-duty vehicles by 2030, complementing the 25% improvement expected from advanced engine research alone.

Component Insights

The Electronic Control Unit (ECU) segment accounted for the largest revenue share of 38.7% in 2024. The demand for ECUs continues to surge as automotive OEMs pivot towards smarter and more efficient powertrain systems. Increasing reliance on real-time data processing, fuel optimization, and regulatory mandates around emissions are compelling automakers to integrate advanced ECUs even in entry-level models. Moreover, the rise of over-the-air (OTA) software updates and growing interest in vehicle-to-everything (V2X) communication are further pushing ECU innovation. In hybrid and next-gen gasoline engines, ECUs now serve as the brain of the vehicle, managing not just combustion but entire energy flows.

The sensors segment is expected to grow at a significant CAGR during the forecast period. With the automotive industry's growing obsession with precision and predictive diagnostics, sensors have transitioned from being mere support components to strategic enablers of vehicle performance. From oxygen and temperature sensors to throttle position and knock sensors, each is critical in relaying live data to the ECU. The integration of more sensor nodes is a direct response to the rise in stringent fuel economy norms and real-time engine monitoring needs, particularly in markets like Europe and China. Additionally, the trend toward electrified auxiliaries in ICE vehicles is boosting the sensor count per vehicle, particularly in hybrid variants.

Engine Type Insights

The gasoline engines segment held the largest share of the automotive engine management system industry in 2024. The focus within this segment is shifting from sheer output to emission control and fuel economy. Turbocharging, direct injection, and variable valve timing technologies are becoming mainstream, requiring more complex and responsive engine management systems. As OEMs strive to meet Euro 6 and China VI standards, advanced EMS integration is seen as non-negotiable. Moreover, the continued popularity of gasoline engines in North America and Asia-Pacific sustains the demand for refined EMS solutions.

The hybrid engines segment is projected to grow at the fastest CAGR over the forecast period. Hybrid powertrains are fast becoming the sweet spot between traditional ICEs and full battery-electric vehicles (BEVs). This has directly accelerated innovation in EMS tailored for dual power sources. Hybrid engines require highly adaptive and intelligent EMS capable of managing transitions between electric and combustion modes without compromising performance or efficiency. The rise of plug-in hybrids (PHEVs) and mild hybrids (MHEVs), especially in urban settings, is creating a niche yet rapid demand for EMS units that can coordinate regenerative braking, engine start-stop, and load balancing in real time.

Vehicle Type Insights

The passenger cars segment dominated the automotive engine management system market in 2024, driven by high vehicle production volumes and the adoption of newer engine architectures. In this space, EMS is evolving from a purely functional component to a strategic differentiator, enabling smoother drivability, compliance with global emission norms, and better fuel economy. Leading automakers are investing heavily in AI-powered EMS that offer predictive analytics, reduce maintenance costs, and enhance user experience, especially in premium segments where driver expectations are evolving.

The two-wheelers segment is expected to grow at a significant CAGR during the forecast period. The two-wheeler market, particularly in regions like India, Southeast Asia, and Latin America, is experiencing a major transformation. As governments enforce tighter emission norms (such as India’s BS6), OEMs are rapidly replacing carburetor-based systems with EMS-driven fuel injection setups. This transition has opened up a lucrative growth window for EMS suppliers, especially those offering cost-efficient and compact solutions. In electric two-wheelers, EMS is also being tailored to monitor battery health, motor control, and regenerative systems, marking a convergence of engine and power management in lightweight vehicles.

Regional Insights

The North America automotive engine management system market accounted for a revenue share of 19.6% in 2024. In North America, the adoption of advanced Automotive Engine Management Systems is strongly influenced by stringent environmental regulations and emission control measures. The U.S. Environmental Protection Agency (EPA), under the Clean Air Act, enforces limits on vehicle emissions, which necessitate the use of EMS to optimize fuel injection, ignition timing, and emission control. Across the region, the increasing implementation of turbochargers, gasoline direct injection (GDI), and stop-start systems, cited in the EPA’s Automotive Trends Report, demonstrates growing reliance on EMS. For instance, GDI was used in just 2.3% of vehicles in 2008 but exceeded 51% by 2020 in the U.S., indicating a rapid shift towards electronically managed engine systems.

U.S. Automotive Engine Management System Market Trends

The U.S. automotive engine management system industry held a dominant position in 2024.In the U.S., engine management systems are becoming more advanced as federal and state regulations push manufacturers to meet aggressive fuel economy and greenhouse gas reduction goals. The EPA reports that the automotive industry has substantially increased the integration of energy-saving technologies like turbocharging and GDI, both heavily reliant on sophisticated EMS. Moreover, EMS technologies are central to compliance with Corporate Average Fuel Economy (CAFE) standards, which mandate steady improvements in vehicle fuel efficiency. The demand for more intelligent engine controls is further driven by the EPA’s continuous enhancements to emissions tracking and diagnostics via OBD systems.

Europe Automotive Engine Management System Market Trends

The Europe automotive engine management system industry was identified as a lucrative region in 2024. Europe is leading globally in emission regulation stringency with the rollout of Euro 7 standards, effective from 2025. These regulations not only reduce permissible tailpipe emissions but also require real-time monitoring of brake and tire particles. Consequently, EMS technologies in Europe are evolving beyond traditional fuel and ignition controls to encompass comprehensive vehicle emission management. According to the European Commission, the Euro 7 standard also mandates that vehicles remain within emission compliance for longer lifespans, increasing the operational importance of EMS across all vehicle types, including hybrids and electric vehicles.

The Germany automotive engine management system market is expected to grow during the forecast period. Germany, as the largest automotive producer in Europe, is at the forefront of EMS innovation. The country is a major stakeholder in the European Battery Alliance (EBA), which supports research and integration of electrification technologies, including battery management systems that coordinate with traditional EMS. The shift toward hybrid and electric powertrains in German automotive production necessitates advanced ECUs and sensors that can manage dual power sources and optimize engine efficiency. Additionally, government support for clean mobility projects has led to robust R&D investments into EMS for hybrid and next-generation vehicles.

The automotive engine management system market in the UK is projected to grow over the forecast period. In the UK, vehicle safety and compliance mandates are directly influencing the functionality of EMS. Since July 2022, Intelligent Speed Assistance (ISA) systems have been mandatory for all new vehicles, requiring real-time speed limit recognition and adjustment, a function coordinated through engine management. EMS now collaborates with advanced driver-assistance systems (ADAS) to ensure both performance and compliance with the UK’s retained EU safety regulations. This trend reflects a growing convergence of safety technologies and engine control systems in the UK automotive sector.

Asia Pacific Automotive Engine Management System Market Trends

Asia Pacific is experiencing rapid EMS adoption due to increasing urbanization, rising pollution levels, and growing vehicle electrification. Countries like Japan, China, and India are actively upgrading their emission standards and investing in EMS-enabled technologies to meet global and domestic compliance. National regulations and industrial transformation policies largely drive these developments. For example, APAC governments are implementing stricter vehicle inspection programs and supporting R&D for cleaner internal combustion engines integrated with smart engine management systems.

The automotive engine management system market in China is anticipated to grow during the forecast period. China has implemented stringent China 6 emission norms, which are comparable to Europe's Euro 6 standards. These norms enforce significant reductions in NOx and particulate matter and require EMS to incorporate advanced control systems and continuous onboard diagnostics (OBD). The Ministry of Ecology and Environment mandates real-time emissions control and compliance, especially in large urban areas. As a result, EMS plays a central role in helping automakers adhere to environmental laws while improving fuel economy. The government’s push for hybrid and electric vehicles also includes incentives for EMS-based innovation.

The Japan automotive engine management system market is projected to grow during the forecast period. In Japan, the Ministry of Economy, Trade and Industry (METI) is advancing EMS technologies through its Automated Driving and Mobility Services (ADMS) program. EMS in Japanese vehicles is increasingly being integrated with autonomous and semi-autonomous systems, optimizing both fuel efficiency and vehicle control. Additionally, Japanese OEMs are deploying EMS across hybrid vehicles to ensure high efficiency and compliance with Japan’s stringent fuel economy standards. These technologies are not only aimed at performance optimization but also support vehicle-to-infrastructure (V2X) systems for smart mobility.

Key Automotive Engine Management System Company Insights

Some of the major players in the automotive engine management systemmarket include Robert Bosch GmbH, Continental AG, Denso Corporation, and BorgWarner Inc. These companies consistently invest in research and development to innovate components like electronic control units and advanced sensors, which are essential for improving fuel efficiency, reducing emissions, and meeting stringent regulatory standards. Their long-standing relationships with original equipment manufacturers (OEMs), presence across multiple vehicle segments, including gasoline, hybrid, and electric powertrains, and ability to scale production efficiently further contribute to their leadership. Additionally, their active participation in strategic partnerships, acquisitions, and global expansion initiatives helps them maintain a competitive edge in the evolving automotive landscape.

-

Continental AG has established itself as a leading player in the market through its comprehensive suite of powertrain technologies and system integration capabilities. The company focuses on developing intelligent engine control solutions that support both traditional internal combustion engines and electrified powertrains. Continental’s expertise lies in offering scalable electronic control units (ECUs), high-precision sensors, and software platforms that enhance engine efficiency, reduce emissions, and support real-time data processing. Its strong collaborations with global automakers and emphasis on sustainability and regulatory compliance position Continental as a key innovator in the transition toward cleaner mobility.

-

DENSO Corporation, a core member of the Toyota Group, is a major contributor to the evolution of engine management systems globally. The company leverages its deep R&D capabilities to develop advanced engine control units, fuel injection systems, and sensor technologies that support cleaner combustion and optimized fuel consumption. DENSO’s EMS solutions are known for their precision and reliability, playing a vital role in enhancing vehicle performance while complying with increasingly stringent emission norms. With a robust presence in both traditional and hybrid vehicle platforms, DENSO continues to expand its footprint through global production facilities and strategic partnerships focused on sustainable automotive technologies.

Key Automotive Engine Management System Companies:

The following are the leading companies in the automotive engine management system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- BorgWarner Inc.

- Hitachi Astemo, Ltd.

- Valeo

- Infineon Technologies AG

- Sensata Technologies, Inc.

- Niterra Co., Ltd.

- Mitsubishi Heavy Industries Ltd.

Recent Developments

-

In August 2024, Continental AG announced a potential spinoff of its automotive business, which includes its engine management system operations, to be presented for shareholder approval by April 2025. This strategic move aims to enhance focus on software-defined vehicle architectures, integrating the engine management system with advanced driver assistance systems (ADAS) for improved vehicle efficiency and safety.

-

In February 2021, Denso Corporation Malaysia, a subsidiary of Denso Corporation, expanded its production capacity in Selangor, Malaysia. The facility focuses on manufacturing air conditioning systems, airbag electronic control units, electric power steering systems, and engine control units.

Automotive Engine Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 67.40 billion

Revenue forecast in 2030

USD 80.25 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, engine type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Robert Bosch GmbH; Continental AG; Denso Corporation; BorgWarner Inc.; Hitachi Astemo, Ltd.; Valeo; Infineon Technologies AG; Sensata Technologies, Inc.; Niterra Co., Ltd.; Mitsubishi Heavy Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Engine Management System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive engine management system market report based on component, engine type, vehicle type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Control Unit (ECU)

-

Sensors

-

Fuel Pump

-

Actuators

-

Others

-

-

Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline Engines

-

Diesel Engines

-

Hybrid Engines

-

Electric Engines

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Two-Wheelers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive engine management system market size was estimated at USD 65.54 billion in 2024 and is expected to reach USD 67.40 billion in 2025.

b. The global automotive engine management system market size is expected to grow at a significant CAGR of 3.6% to reach USD 80.25 billion in 2030.

b. Asia-Pacific (APAC) held the largest market share of 43.8% in 2024. This is due to the increasing urbanization, rising pollution levels, and growing vehicle electrification. Countries like Japan, China, and India are actively upgrading their emission standards and investing in EMS-enabled technologies to meet global and domestic compliance.

b. Some of the players in the automotive engine management system market are Robert Bosch GmbH, Continental AG, Denso Corporation, BorgWarner Inc., Hitachi Astemo, Ltd., Valeo, Infineon Technologies AG, Sensata Technologies, Inc., Niterra Co., Ltd., and Mitsubishi Heavy Industries Ltd.

b. The key driving trend in the automotive engine management system market is the adoption of advanced electronics and sensors to improve fuel efficiency, reduce emissions, and support hybrid and electric powertrains.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."